Appendix A : Transaction Parameters

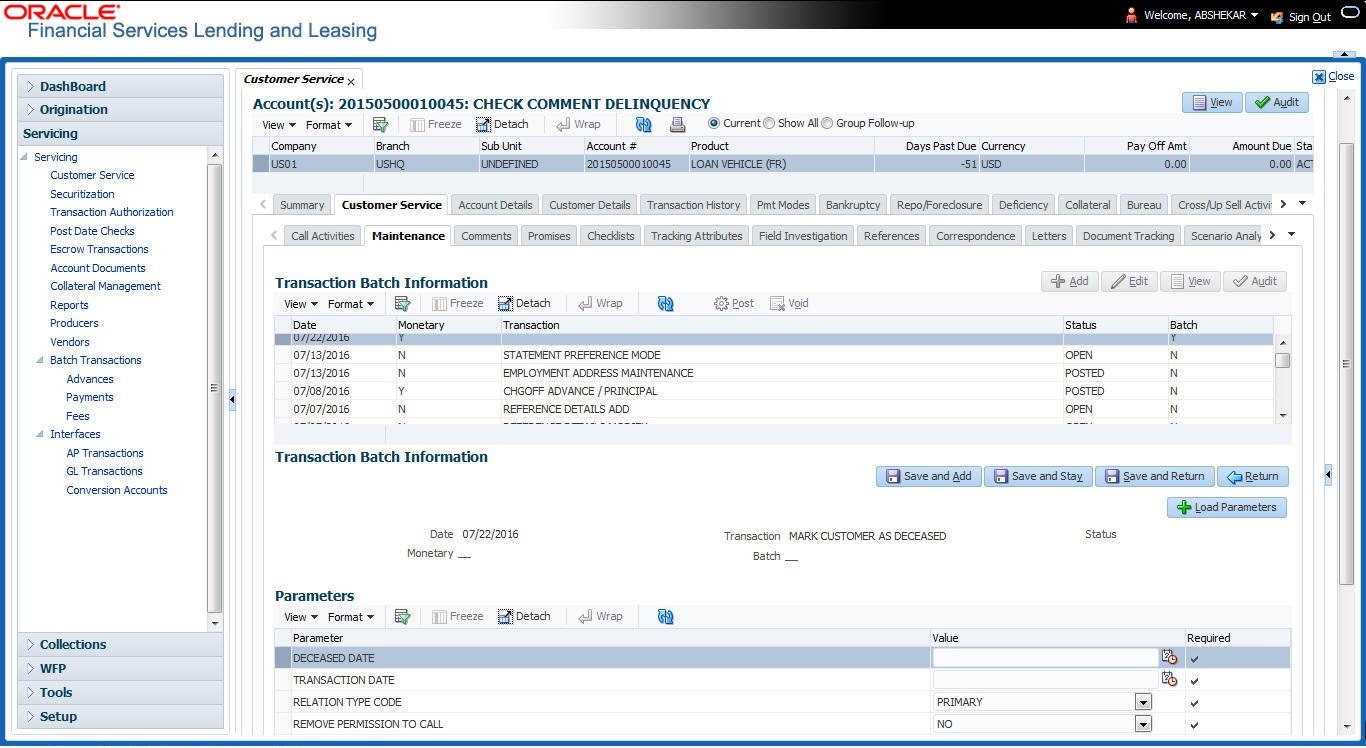

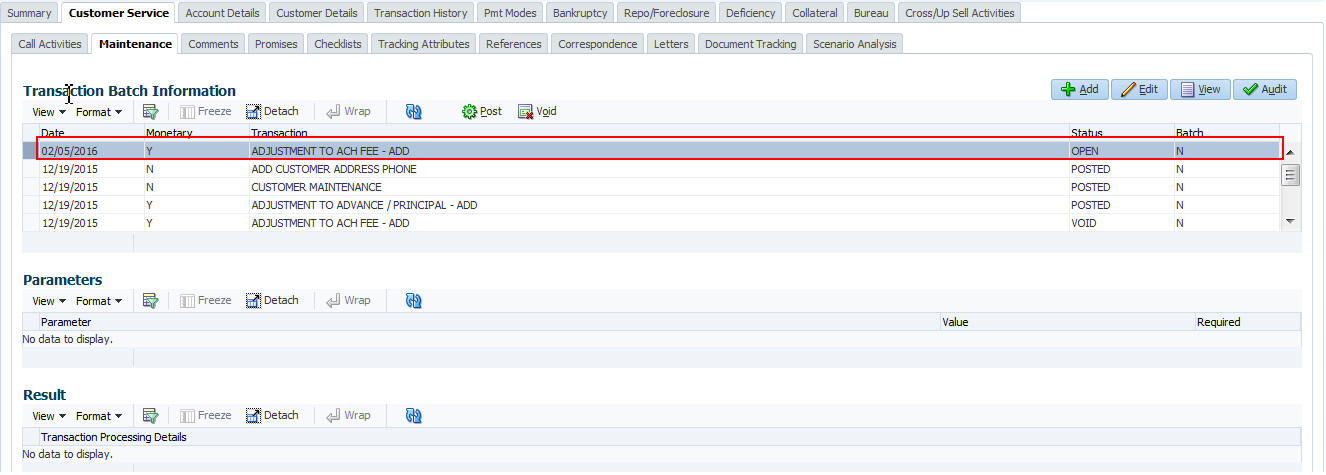

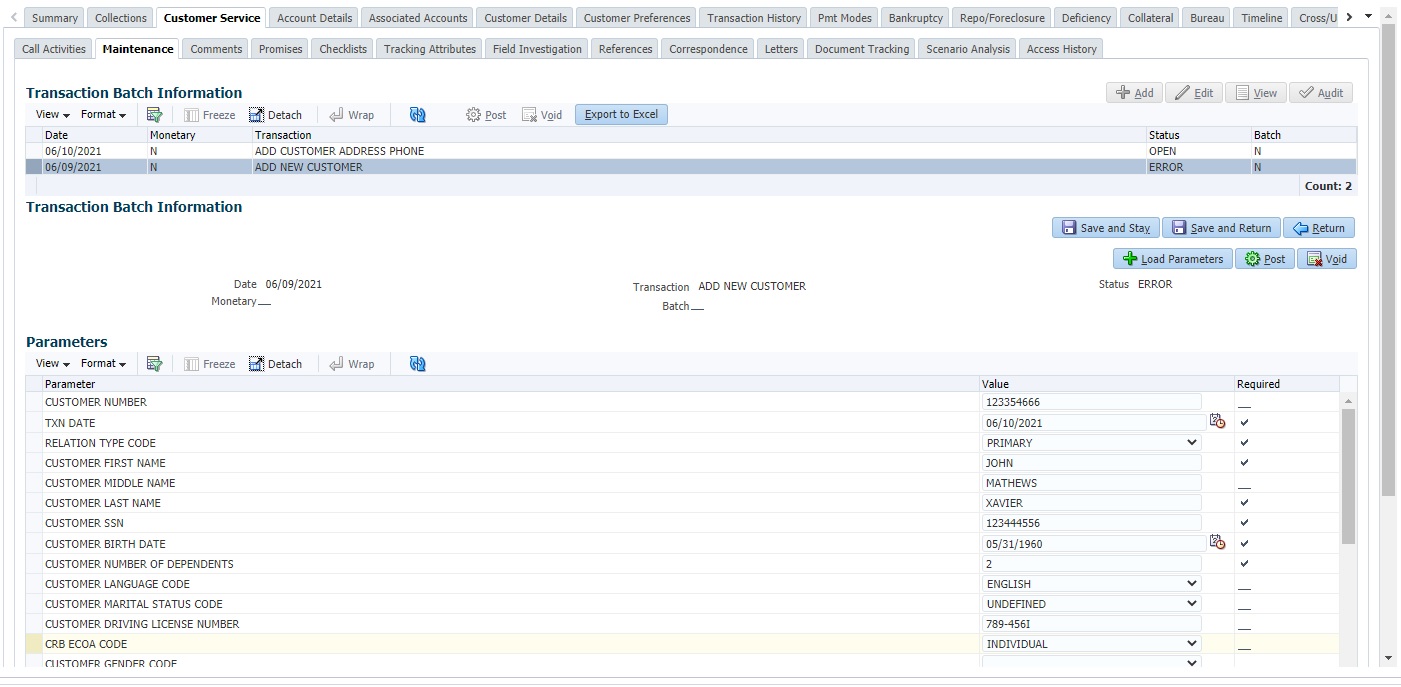

The Customer Service screen’s Maintenance sub tab enables you to post an array of monetary and nonmonetary transactions for any given account. The transactions that are available depend on responsibility of the Oracle Financial Services Lending and Leasing user, nature of account, and whether the account is a Lease.

Appendix A : This appendix catalogues the baseline transaction codes and parameters available on Customer Service screen’s Maintenance sub tab. Instructions on how to use the Maintenance sub tab are located in Customer Service chapter of this User Guide.

A.1 Monetary Transactions

This section catalogues the transaction codes and parameters required to complete the following monetary tasks for Lease:

- Apply, adjust, or waive servicing expenses

- Adjust or waive late charges

- Adjust or waive nonsufficient funds

- Apply, adjust, or waive repossession expenses

- Apply, adjust, or waive bankruptcy expenses

- Apply or adjust phone pay fees

- Change an index/margin rate

- Apply, adjust, or cancel financed insurance

- Generate a payoff quote

- Payoff an account

- Charge-off an account/Do Not Charge-Off an account

- Close an account

- Apply, adjust, or waive an extension fee

- Adjust or waive a prepayment penalty

- Reschedule an escrow payment

- Adjust or waive an escrow payment

- Adjust or waive a payoff quote fee

- Place an account in a nonperforming condition

- Reverse a nonperforming condition

- Reschedule precomputed Lease to interest bearing Lease

- Change profit rate

- Refunding the payment

- Non Refund GL

- ACH Fee Maintenance

- Adjust, charge-off, or waive the advance/principal balance

- Adjust the interest balance

- Stop interest accrual

- Indicate a borrower as on or off active military duty

- Trading of Accounts - Monetary Transactions

- Billing Cycle Change

- Capitalization Maintenance

- Fee Consolidation Maintenance

- Cycle Based Late Fee Adjustment / Waiver

- Change Lease Payment Amount

- Lease Extension

- Change Lease Term

- Lease Security Deposit Adjustment

- Lease Fee Usage Adjustments

- Evergreen Lease Transaction

- Lease Rental/Damage Fee Adjustments

- Account Settlement Transaction

- Accrual and First Payment Date Maintenance

Note

- While posting any monetary transaction that results in increase of account maturity date, system auto validates if the same is within the 'Customer Credit Limit Expiry date' of any one or all of the customer(s)/business who contributed for funding the Account. In case it is greater, system displays an error indicating that the resulting Maturity date is greater than 'Customer Credit Limit Expiry date' and does not allow to post the transaction.

- OFSLL does not allow to post any monetary transaction on/or prior to the status change date. However, in case if the ACH gets the payment return file with NSF (no-sufficient funds) payment status - where the account status is ‘PAID OFF’, system automatically reverses the PAID OFF status and posts the NSF transaction on account.

A.1.1 Late Charges

Late charges occur when payment is not made within the grace period or by the day after payment is due. The due date is determined by the contract.

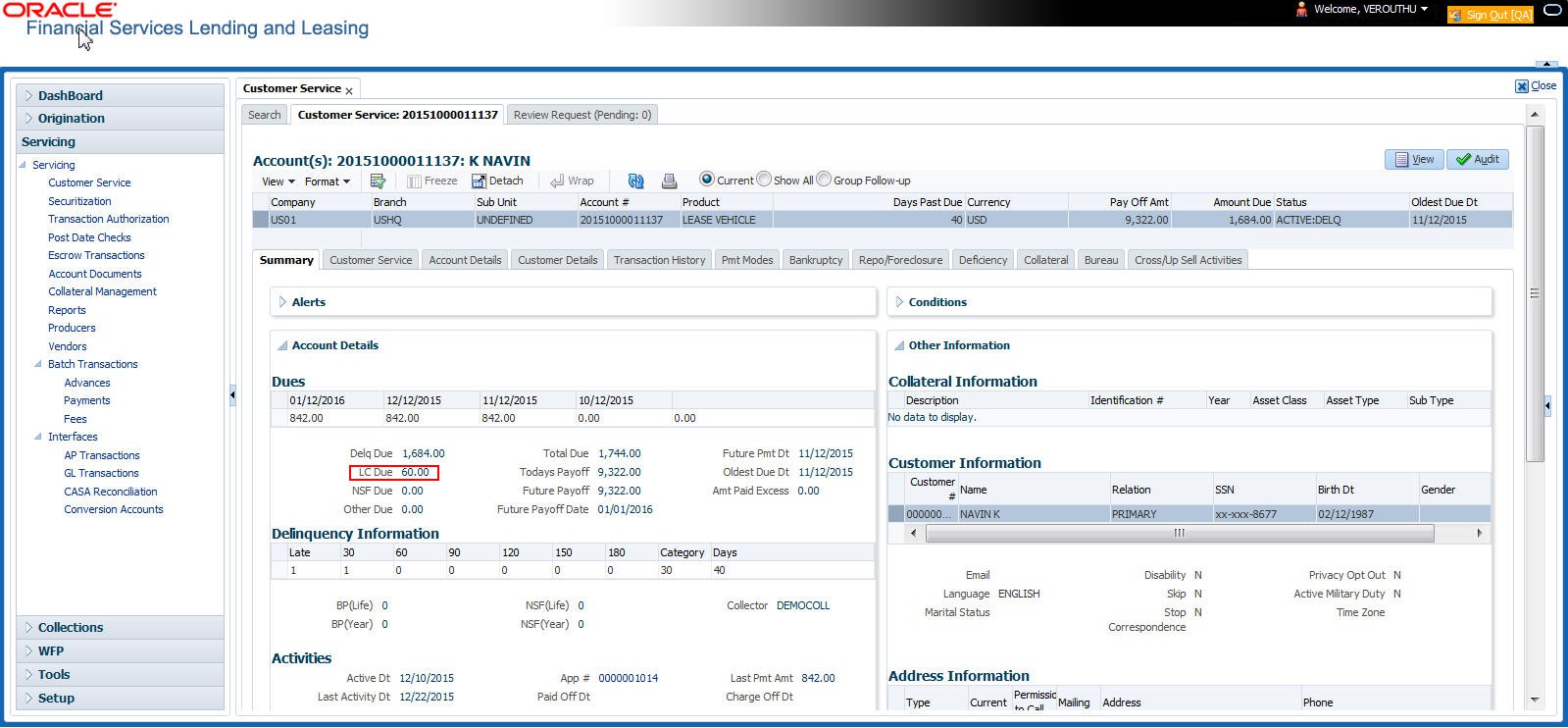

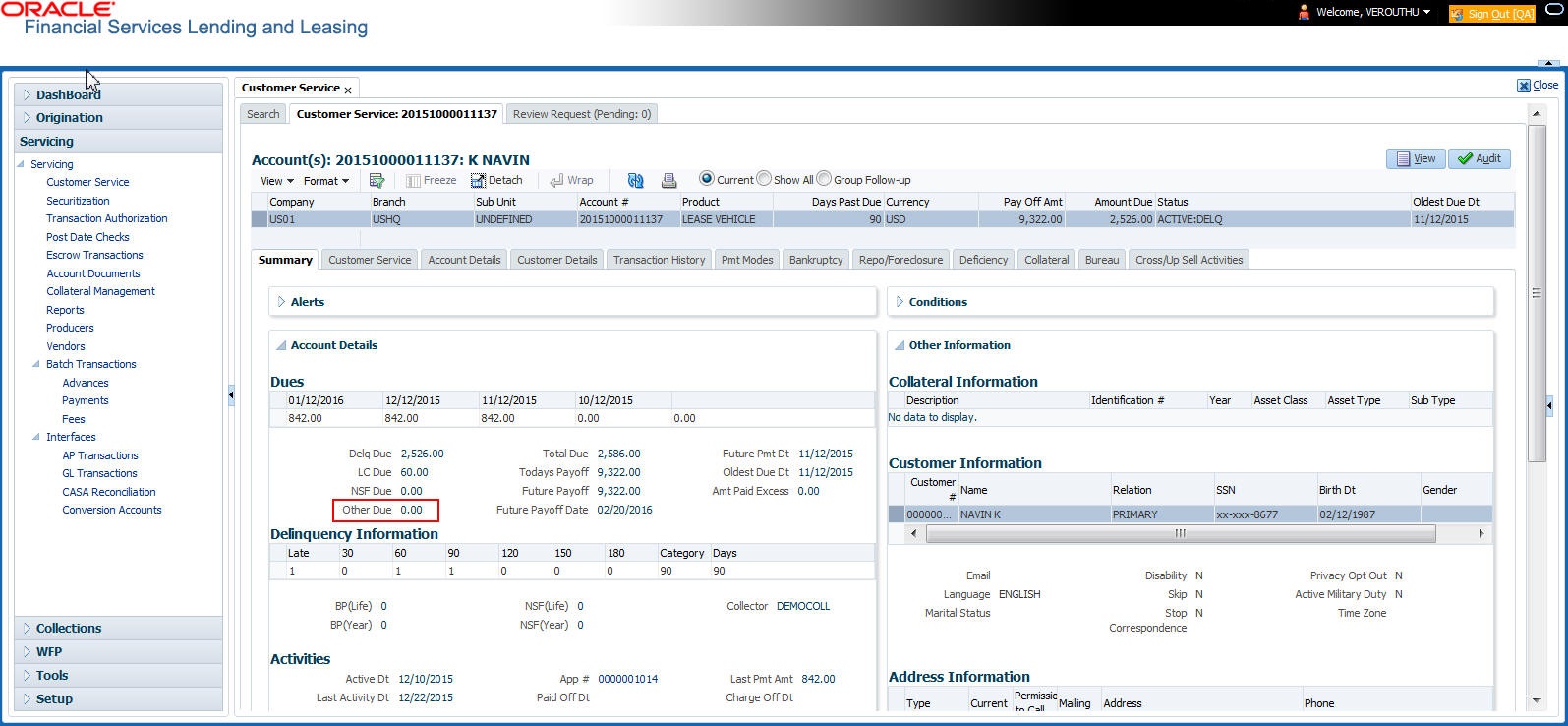

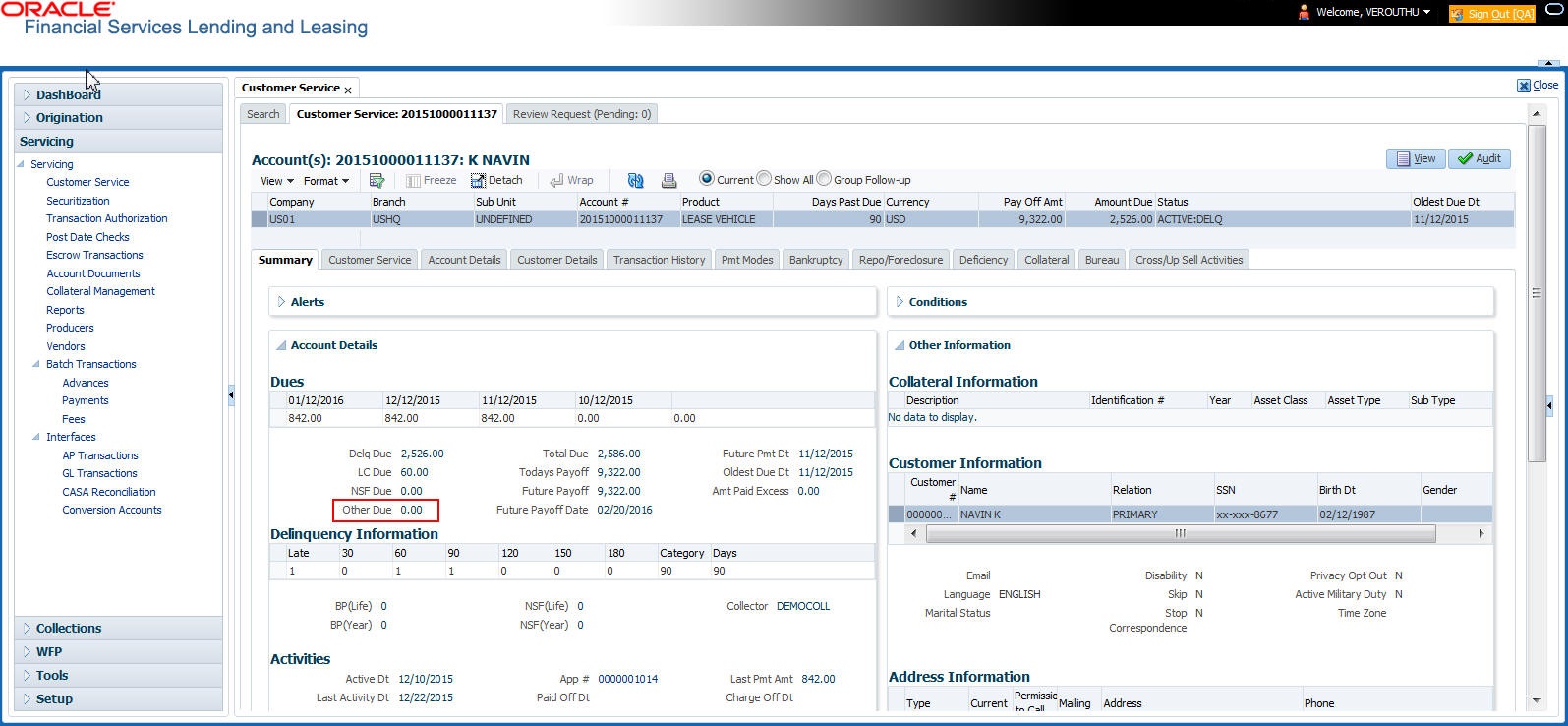

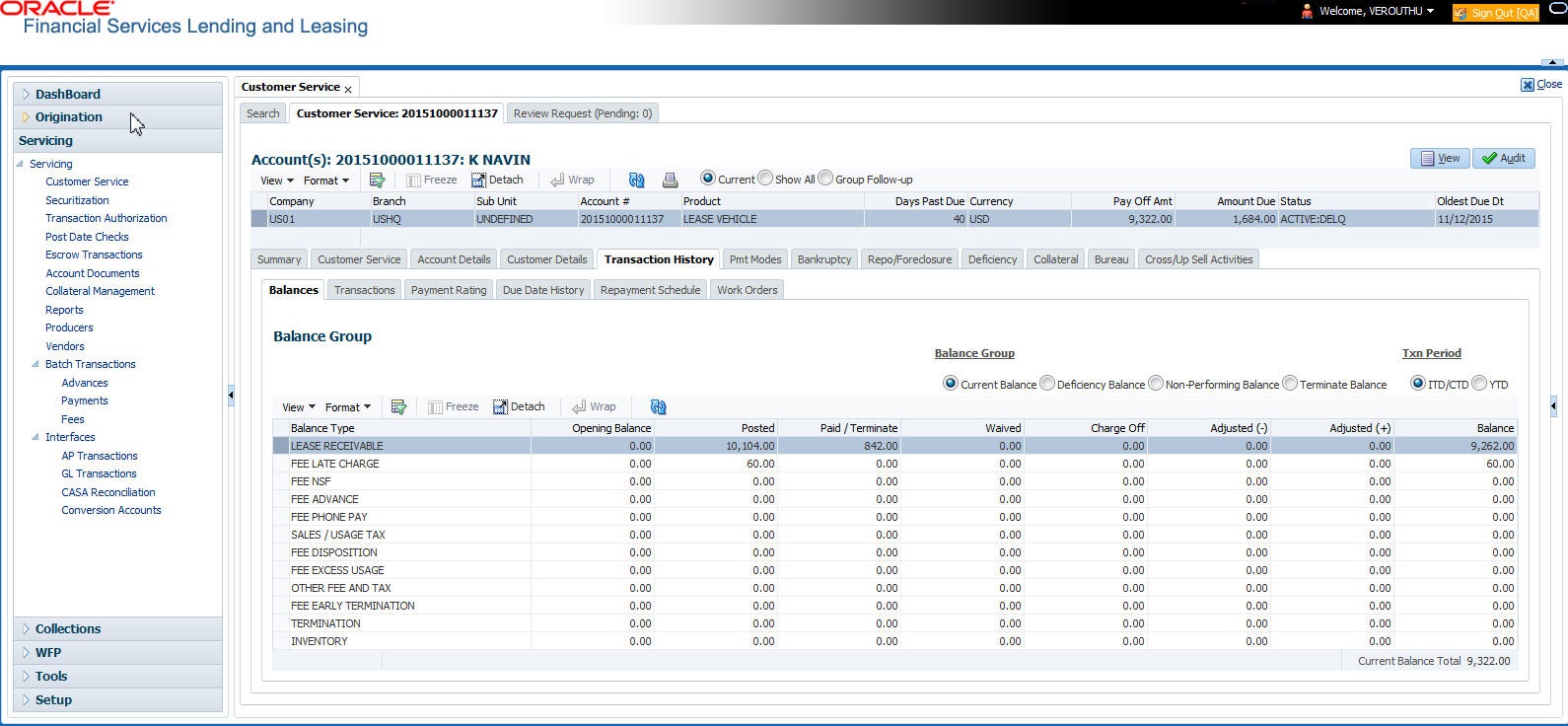

Late charges appear in LC Due field on the Dues section of Summary tab of the Customer Service screen. This is the first screen to appear on the Customer Service screen when you load an account.

To adjust a late charge

Transaction |

Parameters |

Adjustment To Late Charge - Add |

Txn Date Amount |

Adjustment To Late Charge - Subtract |

Txn Date Amount |

To waive a late charge

Transaction |

Parameters |

Waive Late Charge |

Txn Date Amount |

A.1.2 Nonsufficient Fund Fees

Nonsufficient fund fees are posted when a payment does not cover the amount owed. The fee that the system automatically applies to an account is recorded during setup.

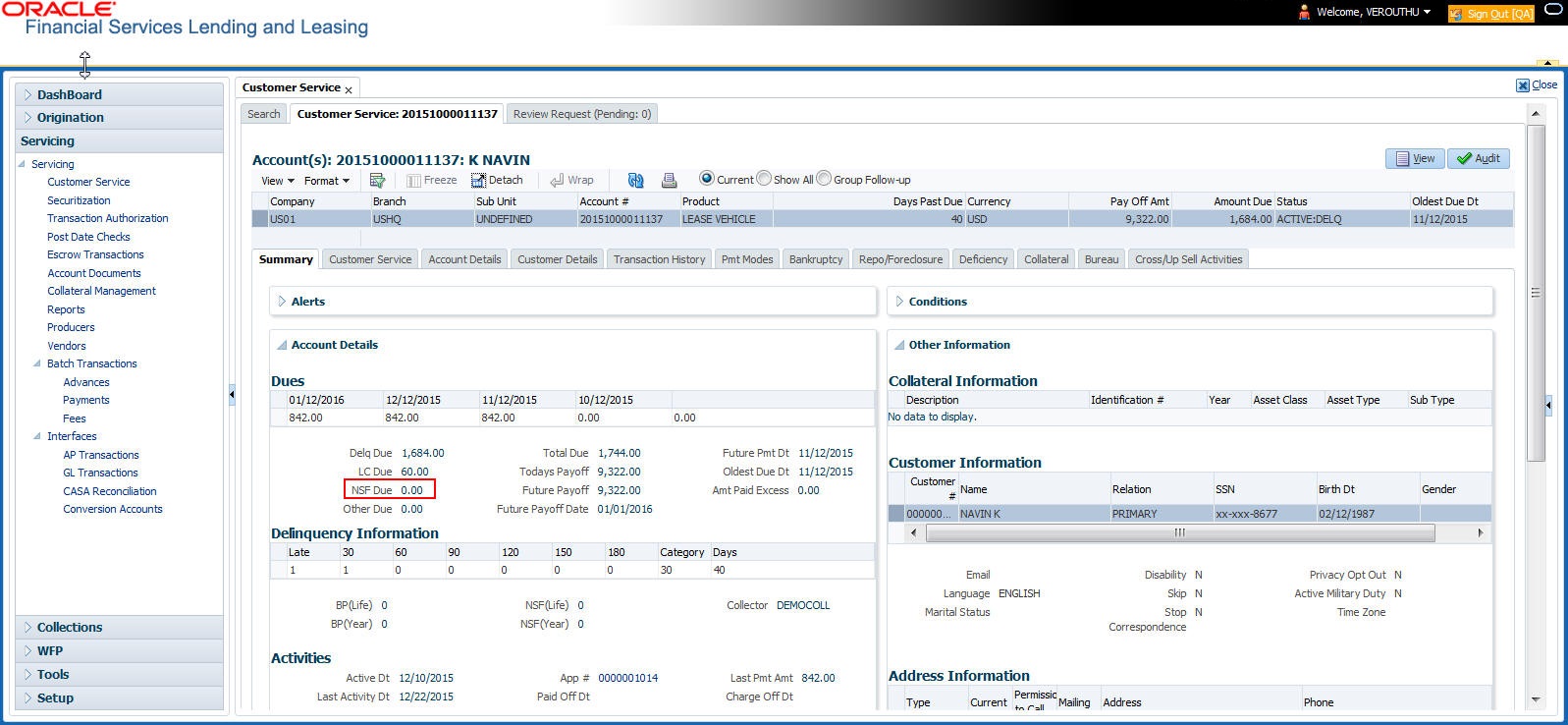

Nonsufficient fund fees appear in the NSF Due field on the Dues section of Summary tab of Customer Service screen. This is the first screen to appear on the Customer Service screen when you load an account.

To adjust a nonsufficient funds

Transaction |

Parameters |

Adjustment To Nonsufficient Fund Fee - Add |

Txn Date Amount |

Adjustment To Nonsufficient Fund Fee - Subtract |

Txn Date Amount |

To waive a nonsufficient funds

Transaction |

Parameters |

Waive Nonsufficient Fund Fee |

Txn Date Amount |

A.1.3 Repossession Expenses

Repossession expenses include any costs incurred while obtaining the asset, including legal fees or storage costs.

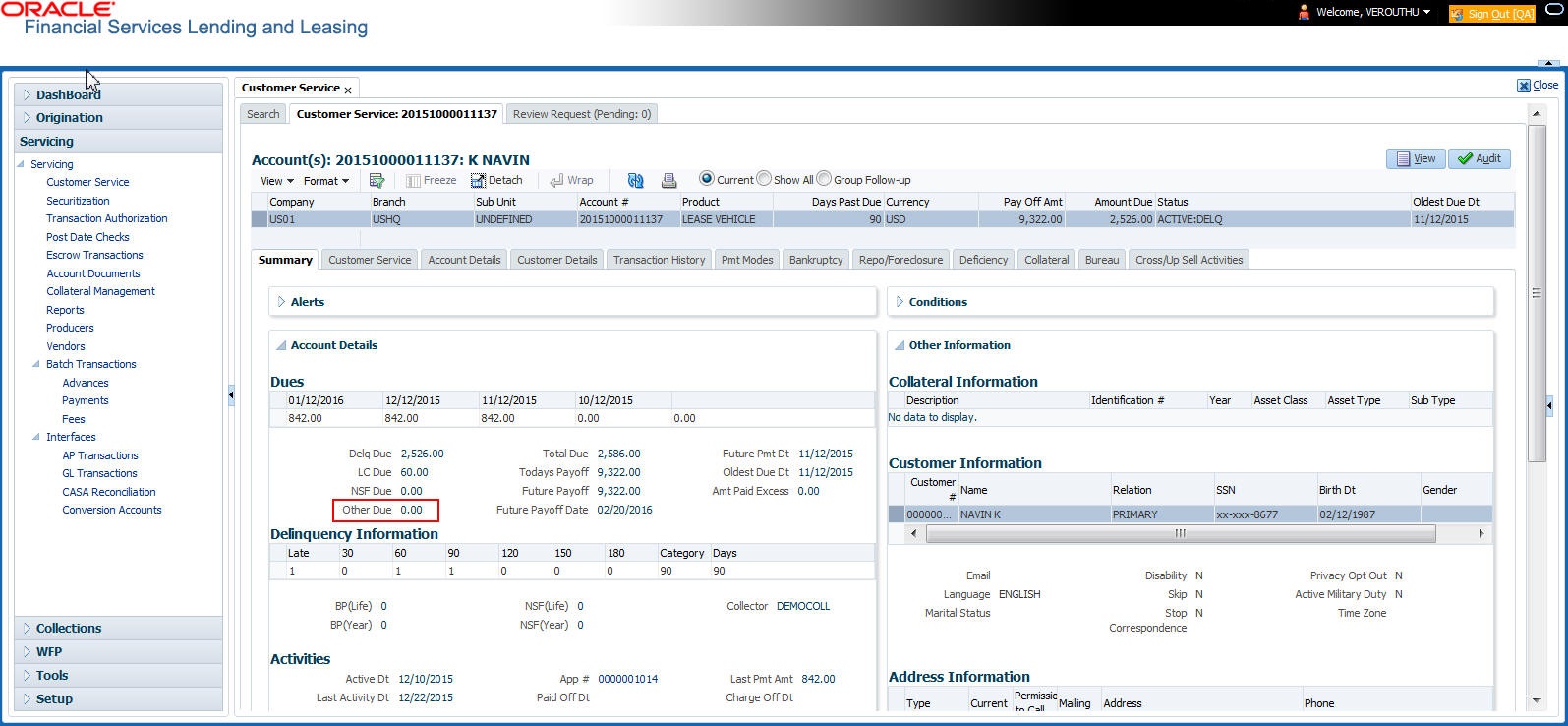

Repossession expenses appear in Other Due field on the Dues section of the Summary tab of Customer Service screen. This is the first screen to appear on the Customer Service screen when you load an account.

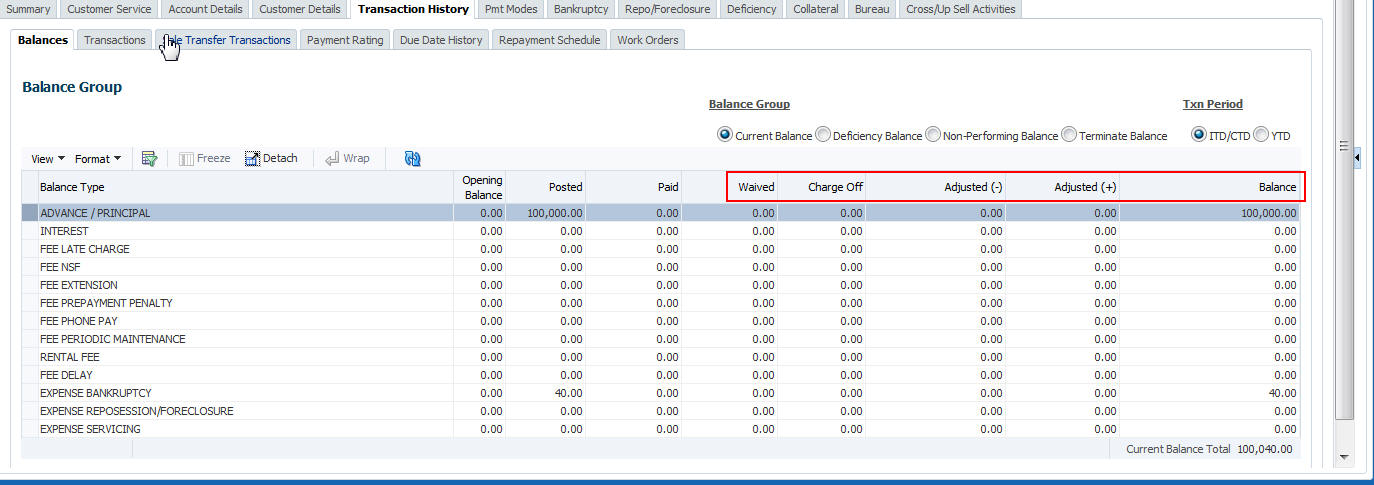

The adjustments will also appear in the corresponding column of Customer Service screen’s Account Balances screen for expense repossession/foreclosure Balance Type-- Waived, Charged Off, Adjusted (-), or Adjusted (+) -- depending on which of the following transactions you perform.

To post a repossession expense

Transaction |

Parameters |

Repossession Expenses |

Txn Date Amount |

To adjust a repossession expense

Transaction |

Parameters |

Adjustment To Repossession Expenses - Add |

Txn Date Amount |

Adjustment To Repossession Expenses - Subtract |

Txn Date Amount |

To waive a repossession expense

Transaction |

Parameters |

Waive Repossession Expenses |

Txn Date Amount |

A.1.4 Bankruptcy Expenses

Bankruptcy expenses include any costs incurred when an account holder declares bankruptcy, such as legal fees or additional collection costs.

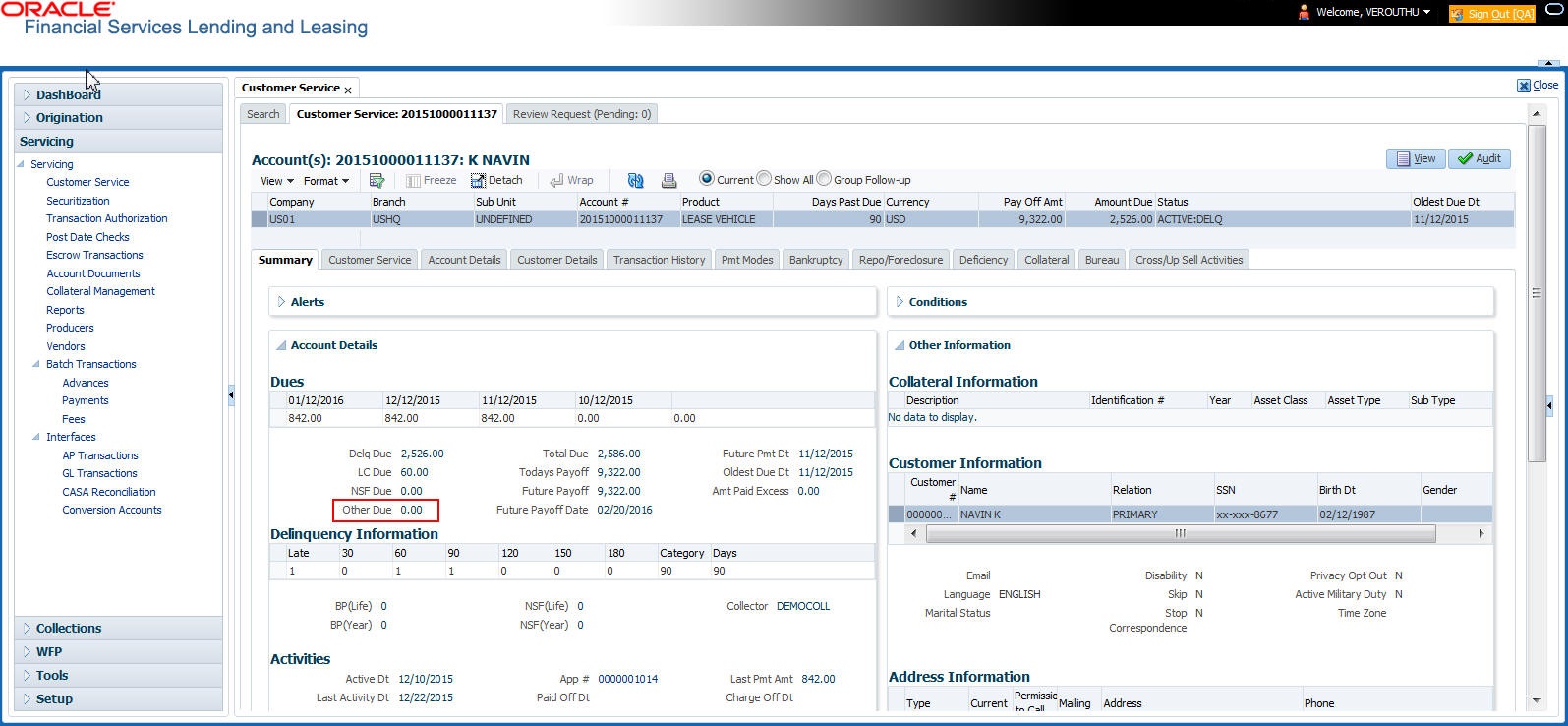

Bankruptcy expenses appear in the Other Due field on the Dues section of Summary tab of Customer Service screen. This is the first screen to appear on the Customer Service screen when you load an account.

The adjustments will also appear in the corresponding column of Customer Service screen’s Account Balances screen for expense bankruptcy Balance Type-- Waived, Charged Off, Adjusted (-), or Adjusted (+) -- depending on which of the following transactions you perform.

To post a bankruptcy expense

Transaction |

Parameters |

Legal Bankruptcy Expenses |

Txn Date Amount |

To adjust a bankruptcy expense

Transaction |

Parameters |

Adjustment To Bankruptcy Expenses - Add |

Txn Date Amount |

Adjustment To Bankruptcy Expenses - Subtract |

Txn Date Amount |

To waive a bankruptcy expense

Transaction |

Parameters |

Waive legal Bankruptcy Expenses |

Txn Date Amount |

A.1.5 Phone Pay Fees

Phone pay fees are where a borrower calls the lender and arranges for a debit to their checking or savings account to make a payment on a Lease account.

Phone pay fees appear in Other Due field on Dues section of the Summary tab of Customer Service screen. This is the first screen to appear on the Customer Service screen when you load an account.

To adjust a phone pay fee

Transaction |

Parameters |

Adjustment to Phone Pay Fee - Add |

Txn Date Amount |

Adjustment to Phone Pay Fee - Subtract |

Txn Date Amount |

To waive a phone pay fee

Transaction |

Parameters |

Waive Phone Pay Fee |

Txn Date Amount |

A.1.6 Financed Insurances

In this section, you can do the following:

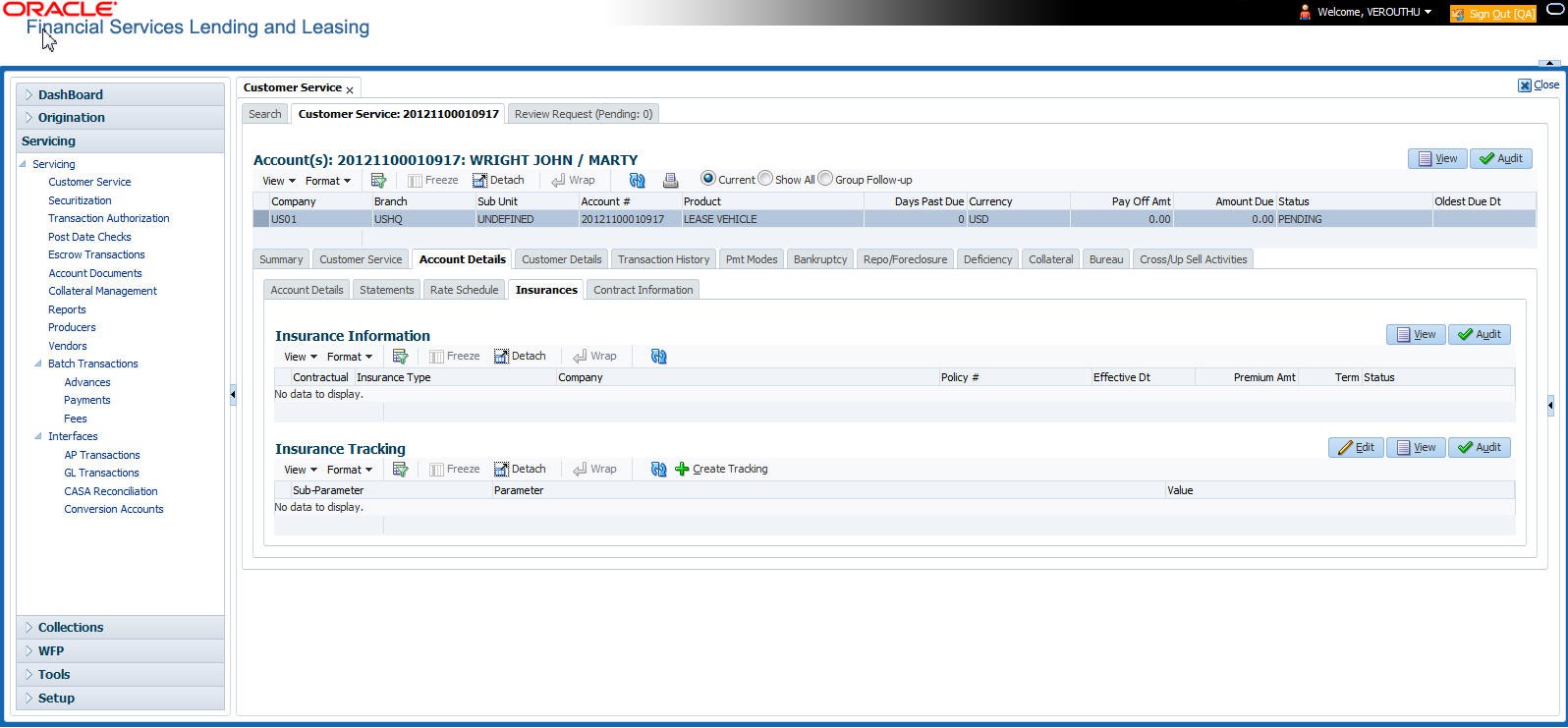

A.1.6.1 Insurance Addition

You can add financed insurance to an existing account with the INSURANCE ADDITION transaction. This transaction adds insurance premium amount to advance/principal balance on the Lease and adjusts the Lease receivables accordingly. The transaction also triggers the process to re-compute repayment amount for Lease. After you post the transaction Lease will be billed for newly computed payment amount and will be considered for delinquencies and fees calculations based on information on the Contract link’s Contract screen. The newly added insurance information can be viewed on Customer Service drop-down link’s Insurances link.

To add financed insurance

Transaction |

Parameters |

Insurance addition |

Txn Date |

Insurance Type |

|

Single/Joint |

|

Insurance Mode |

|

Insurance Plan |

|

Company Name |

|

Phone #1 |

|

Extn #1 |

|

Phone #2 |

|

Extn #2 |

|

Policy # |

|

Policy Effective Date |

|

Premium Amount |

|

Expiration Date |

|

Primary Beneficiary |

|

Secondary Beneficiary |

|

Comment |

A.1.6.2 Insurance Cancellation

You can cancel financed insurance on an existing account with the INSURANCE CANCELLATION transaction. When you post this transaction, the system computes premium refund amount based on the refund method associated with insurance item.

To cancel a financed insurance

Transaction |

Parameters |

Insurance Cancellation |

Txn Date |

Insurance Type |

|

Policy Effective Date |

|

Insurance Refund Amount |

|

Cancellation Reason |

|

Current Usage |

If you enter a value for INSURANCE REFUND AMOUNT parameter, the system overrides calculated refund amount and adjusts advance/principal balance and Lease receivables accordingly. The INSURANCE CANCELLATION transaction re-computes the repayment amount for Lease based on remaining balances. After posting the transaction, Lease will be billed for newly computed payment amount according information on the Contract tab’s Contract sub tab. The insurance cancellation information can be viewed on the Contract link’s Insurances sub screen.

Also if you enter a value for ‘Current Usage’, system computes the rebate amount using the 'Pro Rata (Mileage) method. However system also calculates the rebate amount using ‘Refund Calculation Method' and considers the minimum value out of both.

A.1.6.3 Insurance Modification

You may rectify possible errors resulting from incorrect information entered on the INSURANCE ADDITION transaction (such as an incorrect premium account) with the monetary transaction INSURANCE MODIFICATION.

When you post the INSURANCE MODIFICATION transaction, Oracle Financial Services Lending and Leasing re-computes the repayment amount using new premium amount and adjusts advance/principal balance on Lease and Lease receivables.

To modify financed insurance information

Transaction |

Parameters |

Insurance Modifications |

Txn Date |

Insurance Type |

|

Policy Effective Date |

|

Premium Amount |

A.1.7 Index/Margin Rates

You can change the current Index Rate type (i.e. Prime Rate or Flat Rate) and increase or decrease or even replace the current Margin Rate of a variable rate Lease up to the required basis points using the INDEX / MARGIN RATE CHANGE monetary transaction. However, changing the depreciation rate or margin rate is supported only for ‘Interest Rate’ type of lease calculation method.

To change an index/margin rate

Transaction |

Parameters |

INDEX / MARGIN RATE CHANGE |

TXN DATE - Select the date from adjoining calendar. |

INDEX - Select from the drop-down list as either Prime Rate or Flat Rate. |

|

MARGIN RATE - Specify the Margin Rate. |

|

REASON - Specify additional information (if any). |

|

TXNS ADJUSTMENT TYPE - Select one of the following transaction adjustment type from the drop-down list: ACTUAL - Select this option to replace the existing Margin Rate with the current specified Margin Rate. INCREASE - Select this option to add the current specified Margin Rate to the existing Margin Rate. DECREASE - Select this option to reduce the current specified Margin Rate from the existing Margin Rate. However, note that reduction is permitted only up to existing Margin Rate and system displays an error if the current specified Margin Rate is greater than the existing Margin Rate. |

|

AUTO POST CHANGE PAYMENT - Select either YES or NO from the drop-down list. If there is a change in Margin Rate and this option is selected as YES, then system automatically posts CHANGE PAYMENT AMOUNT transaction along with RATE CHANGE transactions on the account. Behaviour of the CHANGE PAYMENT transaction follows the RATE CHANGE batch job behaviour. If there is a change in Margin Rate and this option is selected as NO, then system posts only RATE CHANGE transactions on the account. However note that this indicator is applicable to accounts funded with products of type 'Interest Bearing Loans' and Reschedule Method as 'Change Payment’. |

On clicking ‘Post’ system posts RESCHEDULE_INDEX monetary transaction to change the Index and Margin Rates. However, note that the ‘Auto Post Change Payment’ transaction changes the payment amount ‘only if’ the new calculated amount is greater than the old value.

For lease accounts, any rate changes (either variable rate or transaction posting rate) are controlled by the limits (values) defined for ‘Payment Caps’ and ‘Rate Cap & Adjustments’ in Setup > Lease Contract screen.

On successful posting of transaction, the counters in Account Details and Summary screen are updated. Also a letter of intimation is generated for correspondence by the scheduled batch LCSTXN_BJ_121_01 (LETTER FOR LEASE MONETARY TXNS) which consists of rescheduled lease contract terms indicating Transaction Date, old and new Index Rate, Margin Rate and Reason.

You can also reverse the rate change by posting 'Rate Change Reversal' transaction and revert to old rate. If there are any payment(s) received before reversal, the same is adjusted to due buckets based on due amount. However, on reversal letter is not generated and has to be manually intimated.

A.1.8 Payoff Quotes

A payoff quote is the amount still owed on account or amount needed to satisfy the Lease. It can be generated anytime and may be requested during a call from a customer, dealer, or insurance agent. A payoff quote can either be generated for current or future date, but not on a back date.

You can post payoff quote during the life of a Rental/Usage Rental Lease based on following conditions:

- If payoff quote is posted before maturity date, system calculates the early closure charges till the payoff valid up-to date using the available base Rental Charge Matrix.

- If payoff quote is posted after last due date or maturity date, system calculates the un-billed rental charges till the payoff valid up-to date using the available excess Rental Charge Matrix. Similarly, for usage based lease contracts, system calculates un-processed usage history records and displays the amount in Unbilled Usage Charges.

The new balances types are displayed in the transaction result section.

The transaction processing details and new balances after posting payoff quote appears in Results section of Maintenance screen.

To generate a payoff quote for an account Lease

Transaction |

Parameters |

PAYOFF QUOTE LEASE |

TXN DATE |

PAYOFF QUOTE VALID UPTO DATE |

|

LEASE BUYOUT INDICATOR |

|

DISPOSITION FEE |

|

EARLY TERMINATION FEE |

|

OTHER FEE |

|

DEPRECIATION ADJUSTMENT |

|

CURRENT USAGE |

|

ASSESS PAYOFF QUOTE FEE |

|

PAYOFF QUOTE LTR PRINT |

|

COMMENT |

A.1.9 Account Paidoff

An account is automatically paid off or marked for payoff processing by the system with a batch transaction when the account balance is $0.00. You can also manually payoff an account with the Maintenance screen. You can also pay off an account using the Consumer Lending (Advance and Payment) form. For more information, see the Payment Processing chapter.

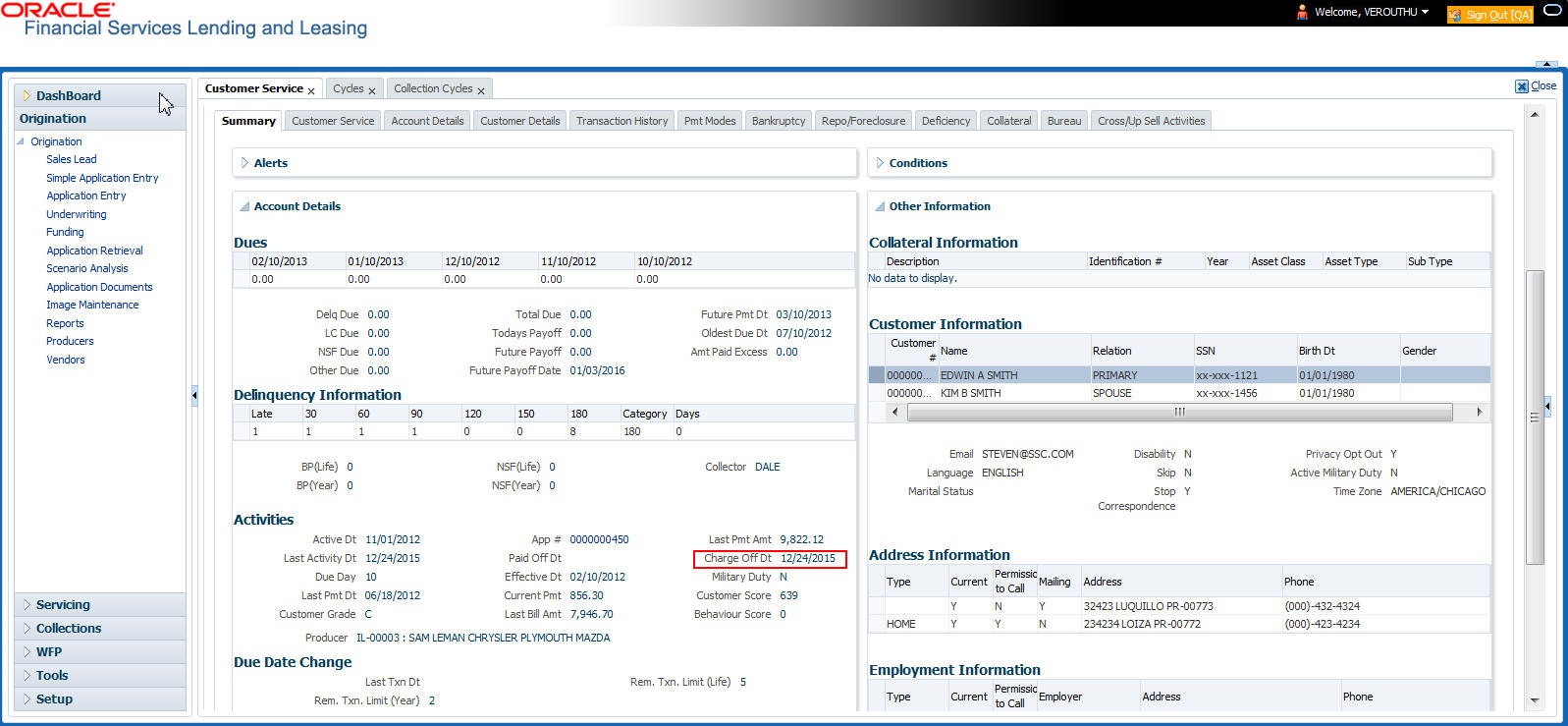

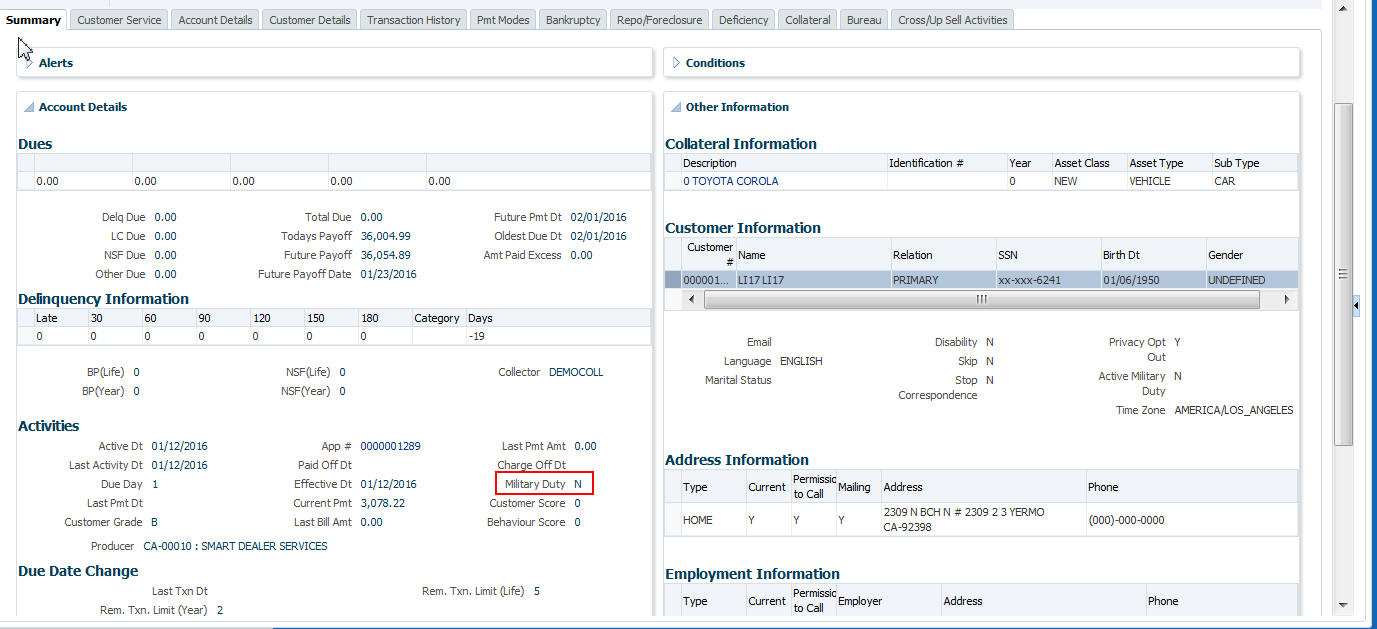

When you payoff an account, the system changes the account’s status to PAID OFF. The date the account was paid off appears in Activities section’s Paid Off Dt field on Account Details screen.

The system also notes the amount of the principal that was waived when account was paid off in the Waived column on Account Balances screen.

To pay off an account

Transaction |

Parameters |

Paid off |

Txn Date |

If you reverse the payoff payment using Customer Service form, then the pay-off is automatically reversed. The system changes the account’s status from PAID OFF to ACTIVE when you refresh the account.

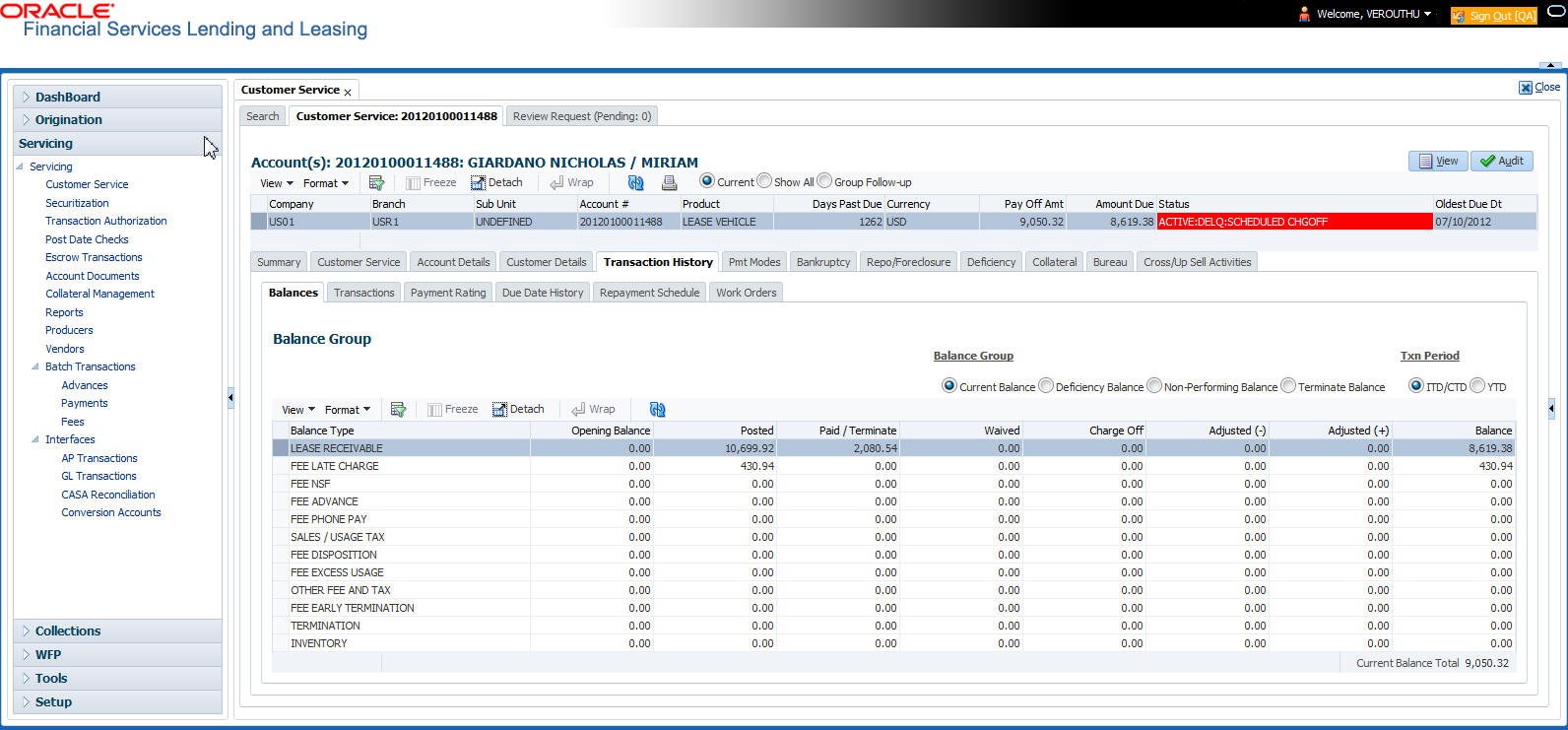

A.1.10 Account Charge Off

Charging off an account refers to when a lender decides to take a loss on an account, signalling that attempts to recover the Lease have failed. In calculating a charge off, the system considers the total compensation amount (up front compensation plus remaining compensation amount). It is different from the waive off process since a waive off is a concession offered to the customer on payment of some component, such as a late fee. The repayment of the original Lease still continues in waive off process.

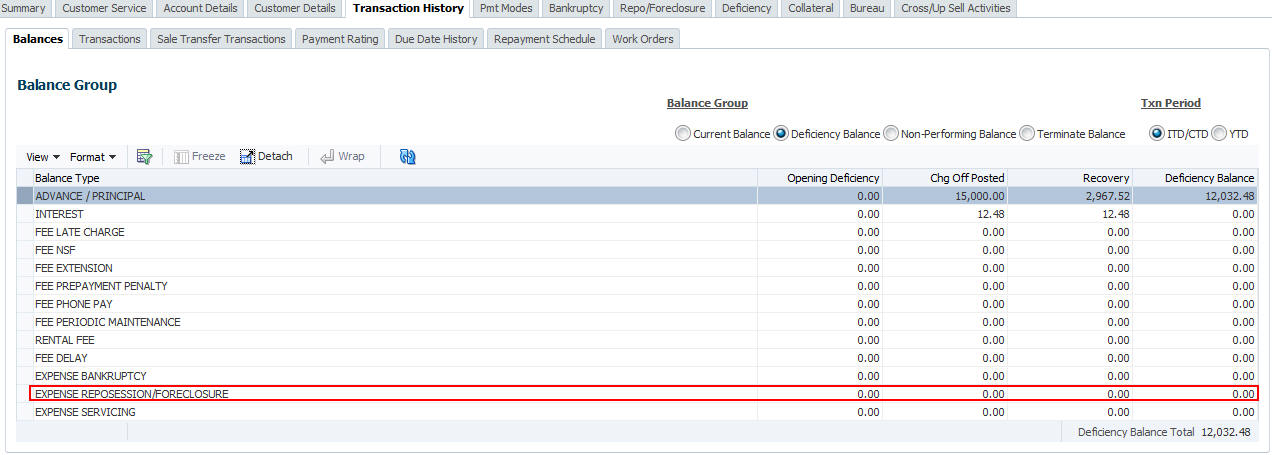

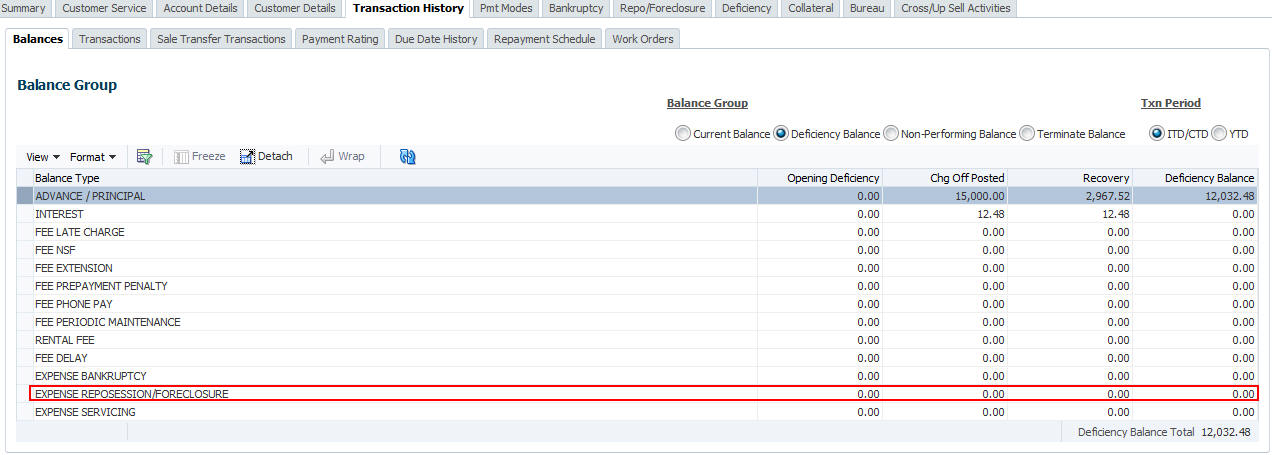

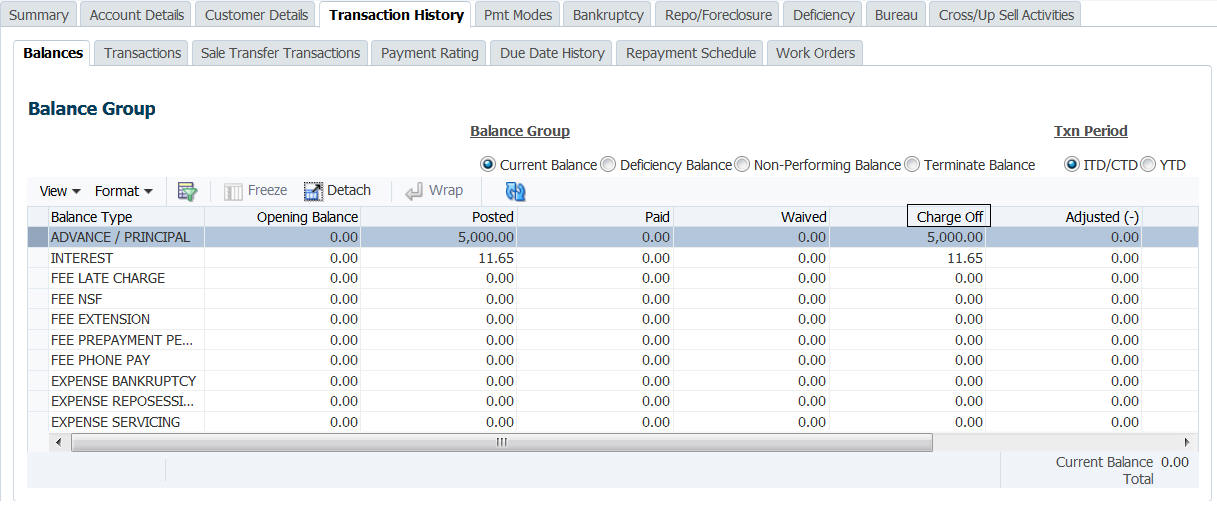

When you charge off account, the system changes the status to CHARGED OFF. The balance on the account appears on Customer Service form’s Balance screen when you choose Deficiency Balance in the Balance Group section.

The date of the charge off appears on Account Details screen in Activity section’s Chargeoff Dt field.

However, you can select the ‘Do Not Auto Charge Off’ condition to ignore few account conditions, for the charge-off processing batch job. When an account is marked with the condition DO NOT CHARGE OFF, then batch job will not pick the account for charge off processing.

You can add ‘Do Not Auto Charge Off’ condition in addition to the already existing condition.

You can post CHARGED OFF transaction on the entire hierarchy of Associated/Linked Accounts along with the Master Account i.e. if CHARGED OFF is initiated from an Associated/Linked account, system can post CHARGED OFF on all ACTIVE associated/linked accounts in the hierarchy along with the Master Account.

However, note that you can post CHARGED OFF on Master Account only if Associated Accounts are in TRADED, VOID, TERMINATE, PAID, and CHGOFF status.

To charge off an account

Transaction |

Parameters |

Charged Off |

TXN DATE |

PROCESS MASTER ACCOUNT |

|

PROCESS SAME PRODUCT TYPE AND FUNDING TYPE ACCOUNTS |

|

PROCESS MASTER ASSOCIATED ACCOUNTS |

|

PROCESS ALL ACCOUNTS BASED ON THE SALES ORDER NUMBER |

|

PROCESS LINKED ACCOUNT |

While posting the transaction,

- If PROCESS MASTER ACCOUNT is selected as ‘YES’, then CHARGE OFF transaction is automatically posted to corresponding Master Account. If selected as ‘No’, then CHARGE OFF transaction is posted to current account and its Linked account.

- If Master Account has multiple Linked and Associated Accounts with status TRADED, VOID and Account Close Indicator =N, then system displays an error indicating ‘Invalid status for Associated Accounts’.

- If PROCESS SAME PRODUCT TYPE AND FUNDING TYPE ACCOUNTS is selected as ‘Yes’, then CHARGE OFF transaction is automatically posted to accounts belonging to same product type and selecting ‘No’ posts the transaction to ALL accounts. However, this parameter has no relevance if the 'Process to Master Account' is not set to 'Y'.

- If PROCESS MASTER ASSOCIATED ACCOUNTS is selected as 'Yes', then CHARGE OFF transaction is automatically posted to all Associated Accounts under the Master Account and selecting 'No' posts extension only to current account.

- If PROCESS ALL ACCOUNTS BASED ON THE SALES ORDER NUMBER is selected as ‘YES’, then transaction is automatically posted to all corresponding account(s) which are having the same Sales Order number as that of current account where this transaction is being posted. However before posting, system considers the value defined for other parameters. See section, ‘Processing with Combination of Transaction Parameters’.

- If PROCESS LINKED ACCOUNT is selected as ‘YES’, then CHARGE OFF transaction is automatically posted to current account and its Linked Account(s).

Note that during reversal of a CHARGED OFF transaction on hierarchy of Associated/Linked Accounts, ensure that Master Account is in ACTIVE status. Else, system restricts posting Reversal of a CHARGED OFF transaction for an Associated Account and displays an error indicating ‘CHARGED OFF cannot be reversed - Master Account must be in ACTIVE status’.

A.1.11 Account Closure

The system automatically closes an account when its status changes from ACTIVE status to Paid or Void. It is manually closed if it has status as CHARGE OFF. Accounts marked as Closed are not processed and after a period of time are purged from Oracle Financial Services Lending and Leasing.

To close an account

Transaction |

Parameters |

Account Close |

Index Txn Date |

A.1.12 Advance (Principal) Balance

The advance (or principal) balance is posted automatically when you fund the contract on Funding screen. You are not allowed to post the advance with Customer Service screen. However, you can waive, charge off or adjust the advance or principal.

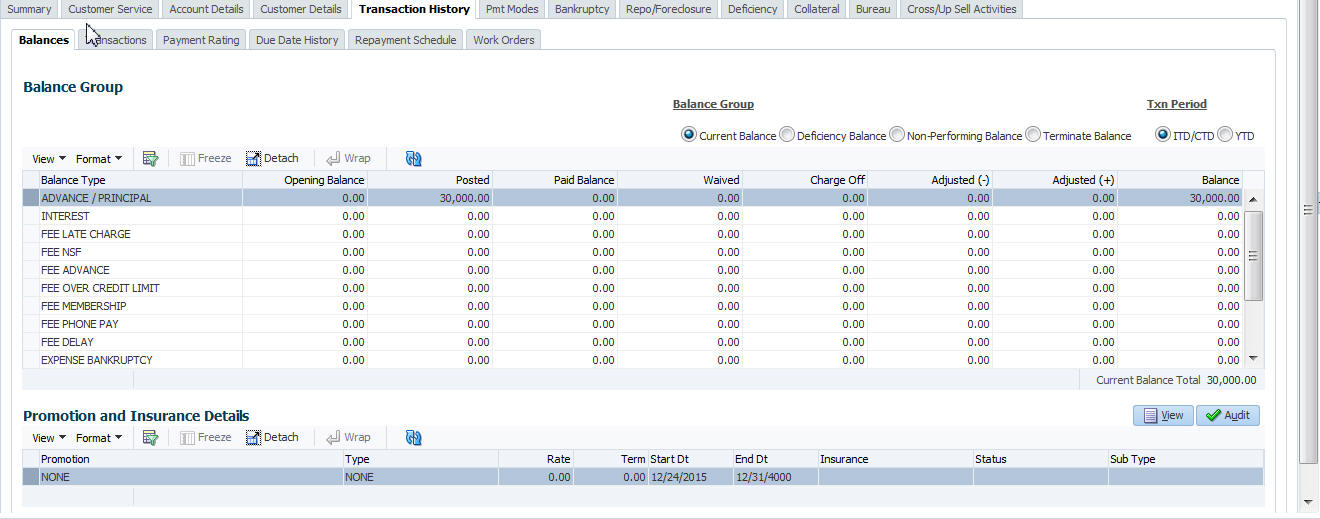

The adjustments will appears in the corresponding column of Customer Service screen’s Account Balances sub tab for ADVANCE / PRINCIPAL Balance Type -- Waived, Charged Off, Adjusted (-), or Adjusted (+) -- depending on which of the following transactions you perform.

To adjust the advance/principal balance

Transaction |

Parameters |

Adjustment To Advance/Principal - Add |

Txn Date Amount |

Adjustment To Advance/Principal - Subtract |

Txn Date Amount |

To charge off the advance/principal balance

Transaction |

Parameters |

Chgoff Advance/Principal |

Txn Date Amount |

To waive the advance/principal balance

Transaction |

Parameters |

Waive Advance/Principal |

Txn Date Amount |

A.1.13 Interest

The interest is accrued or posted automatically when you post the payment on Advance screen’s Advance Entry tab. You cannot post the interest in the Customer Service screen; however, you can adjust or waive interest.

The adjustments will appears in the corresponding column of Customer Service form’s Account Balances screen for INTEREST Balance Type-- Waived, Adjusted (-), or Adjusted (+) -- depending on which of the following transactions you perform.

To adjust the interest

Transaction |

Parameters |

Adjustment To Interest - Add |

Txn Date Amount |

Adjustment To Interest - Subtract |

Txn Date Amount |

To waive the interest

Transaction |

Parameters |

Waive Interest |

Txn Date Amount |

A.1.14 Interest Accrual

You can start or stop interest accrual on a Lease.

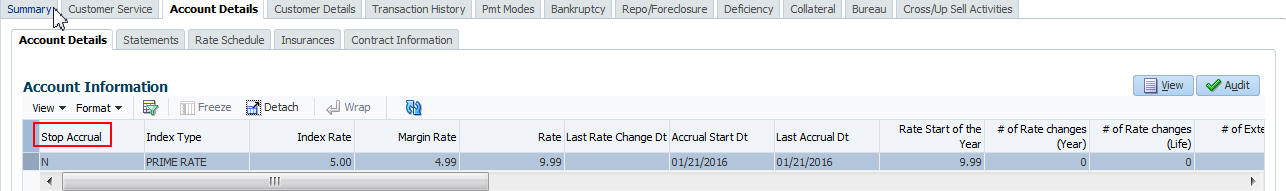

On the Lease Details screens, Stop Accrual box is selected in Interest and Accruals section.

To remove Stop Accrual indicator, post the start ACCURAL transaction.

To start interest accrual for an account

Transaction |

Parameters |

Start Accrual |

Txn Date |

To stop interest accrual for an account

Transaction |

Parameters |

Stop Accrual |

Txn Date |

A.1.15 Active Military Duty (For Lease)

The Servicemembers Civil Relief Act of 2003 (SCRA), formerly known as the Soldiers and Sailors Civil Relief Act of 1940 (SSCRA), is a federal law that gives military members some important rights as they enter active duty military service. The law also provides protection against certain legal actions during the term of active duty military service. The SCRA function is currently available in the system for Lease.

For lease accounts, on posting the SCRA transaction - BORROWER ON MILITARY DUTY(FOR LEASE), there is no change on the interest rate. On successfully posting the transaction, the following conditions are posted on the account:

- DO NOT CHARGE OFF

- DO NOT TERMINATE

- DO NOT REPOSSESS

To indicate that a borrower is on active military duty

Transaction |

Parameters |

BORROWER ON MILITARY DUTY(FOR LEASE) |

Txn Date |

Borrowers Relation With Account |

|

Active Duty Order Reference |

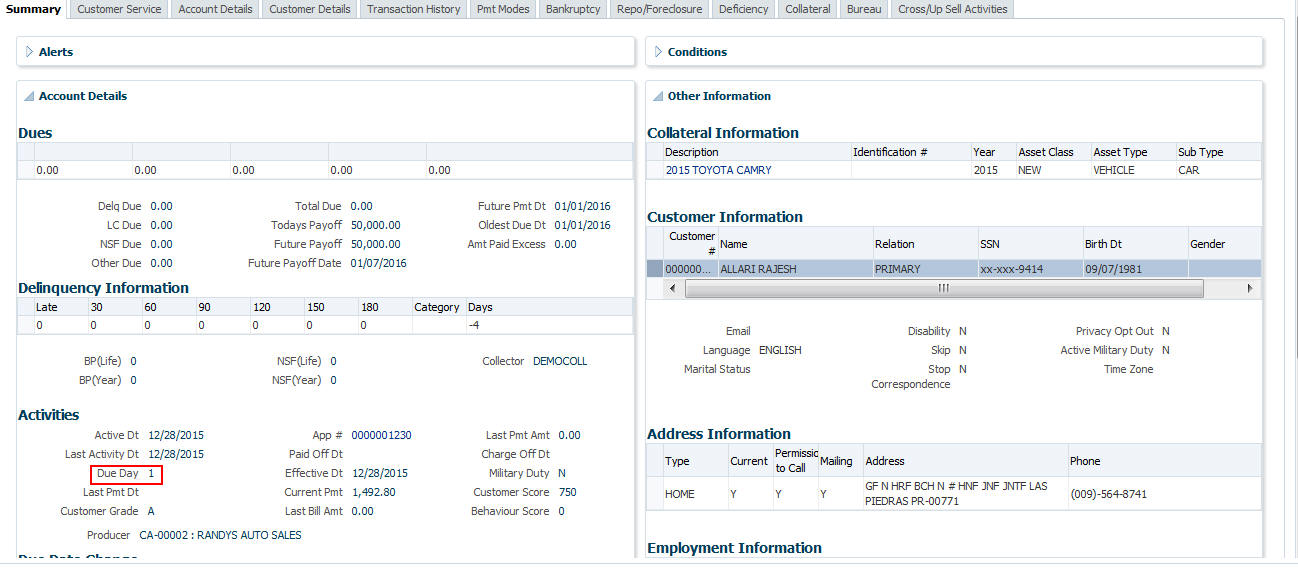

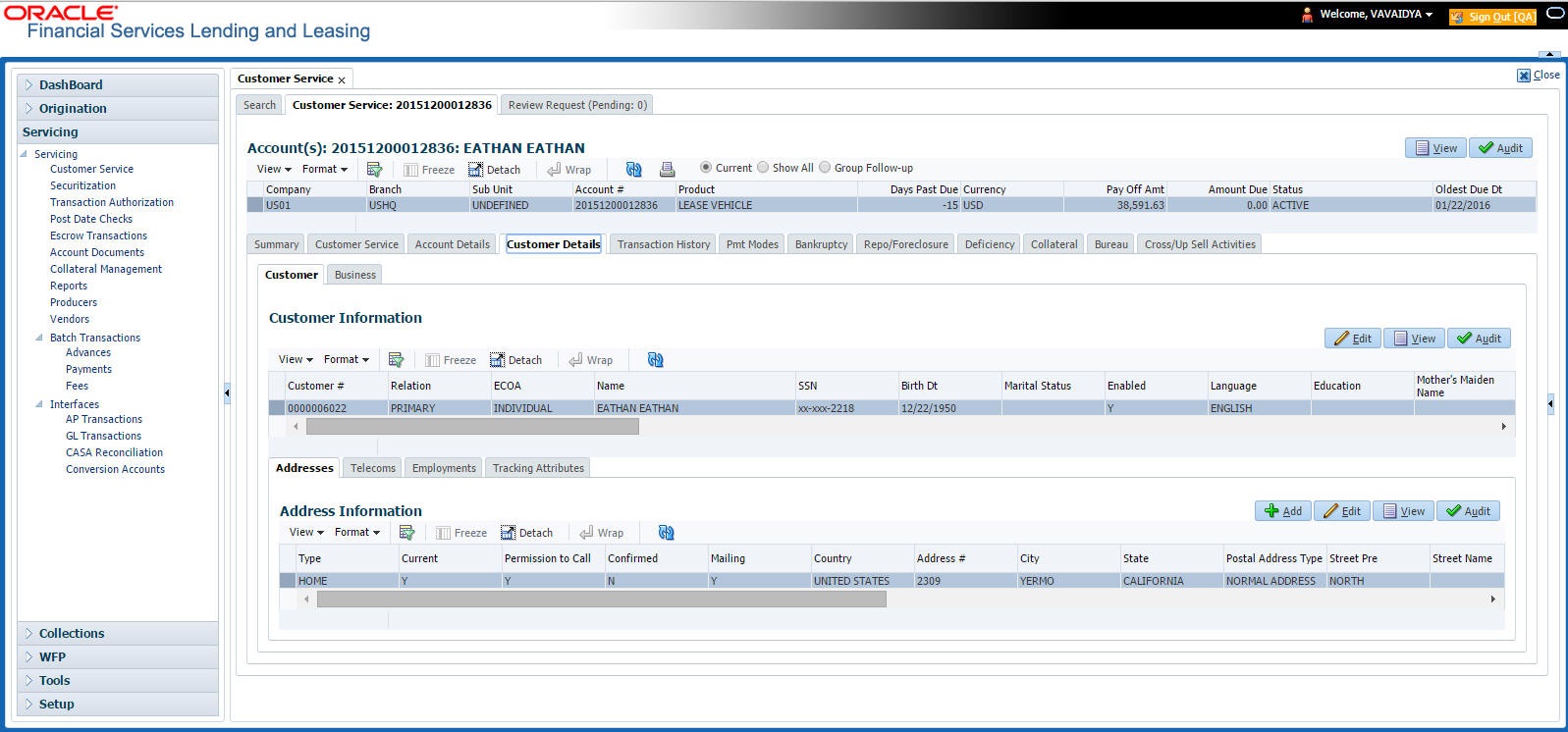

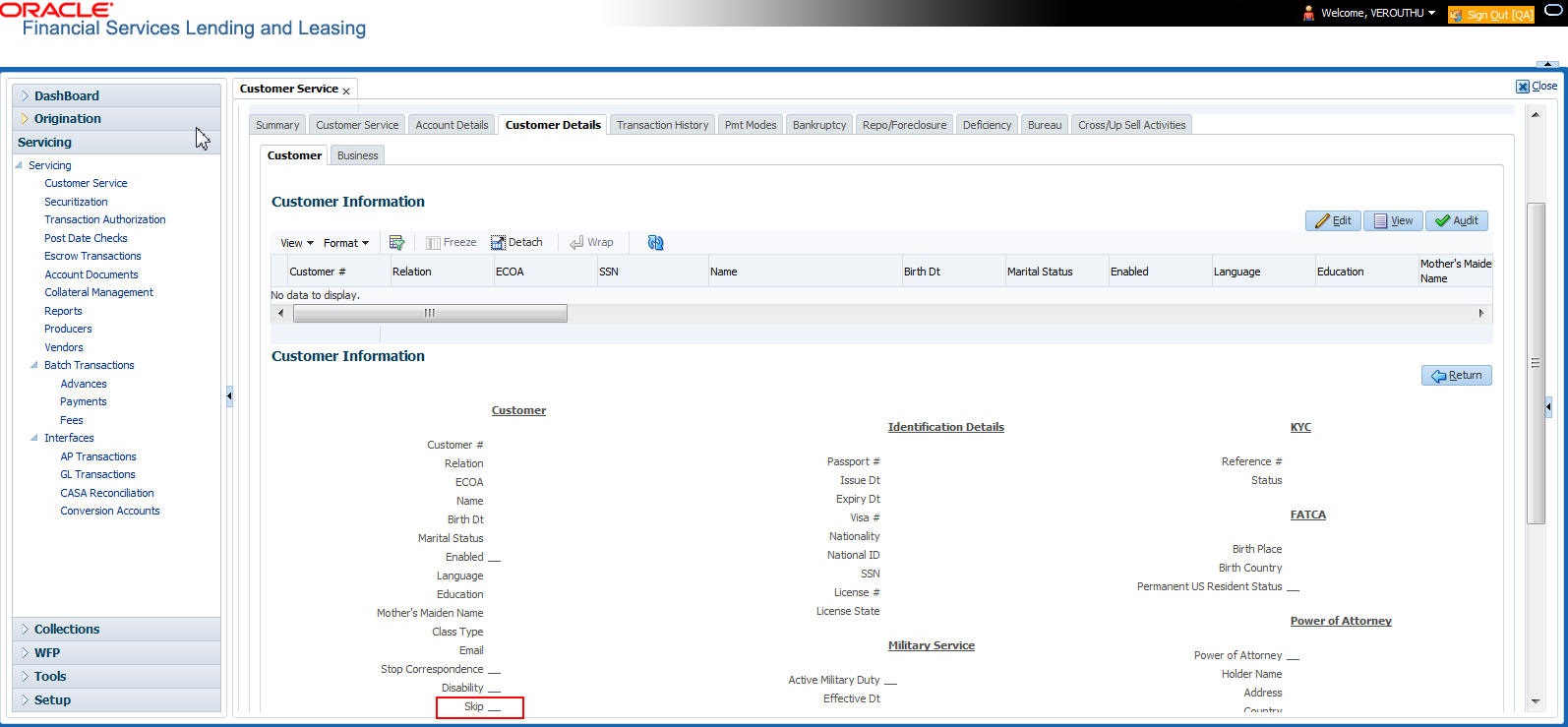

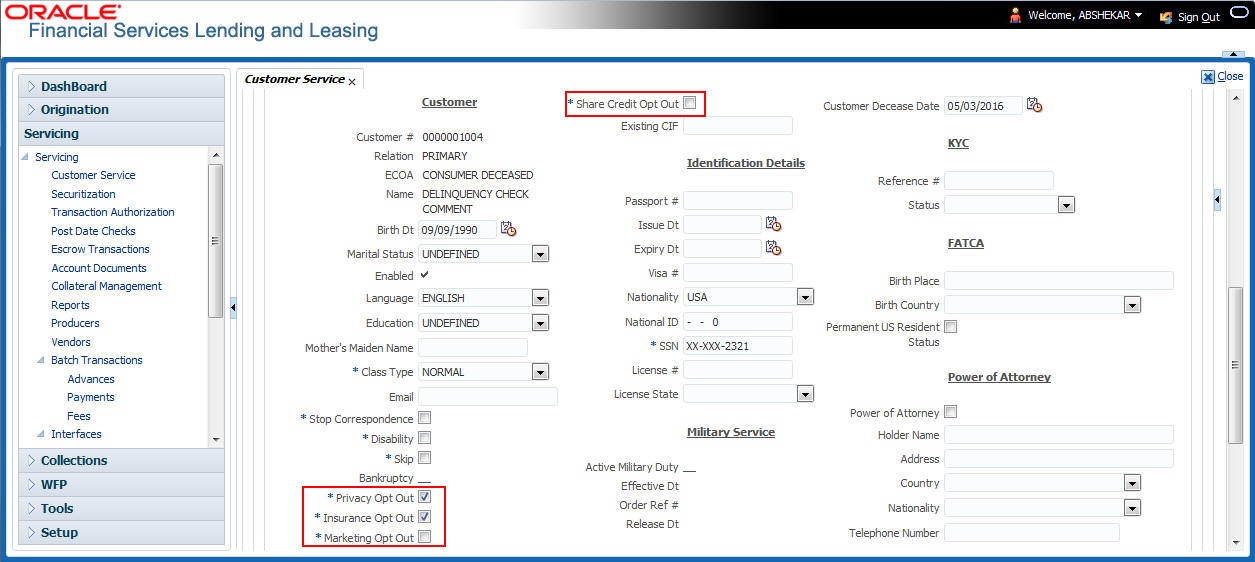

After you post this transaction, the Military Duty box (Account Details screen Activities section) and Active Military Duty box (Customer Details screen Military Service section) are selected. Oracle Financial Services Lending and Leasing changes the condition of the account to ON ACTIVE MILITARY. Details of the transaction appear in the Military Services section on Customer Details screen.

OFF-Military Duty (For Lease)

If the borrower is off-military duty, the transaction ‘BORROWER OFF MILITARY DUTY’ is posted to restore the interest and instalment amount for the remaining term.

To indicate that a borrower is no longer on active military duty

Transaction |

Parameters |

BORROWER OFF MILITARY DUTY(FOR LEASE) |

TXN DATE |

BORROWERS RELATION WITH ACCOUNT |

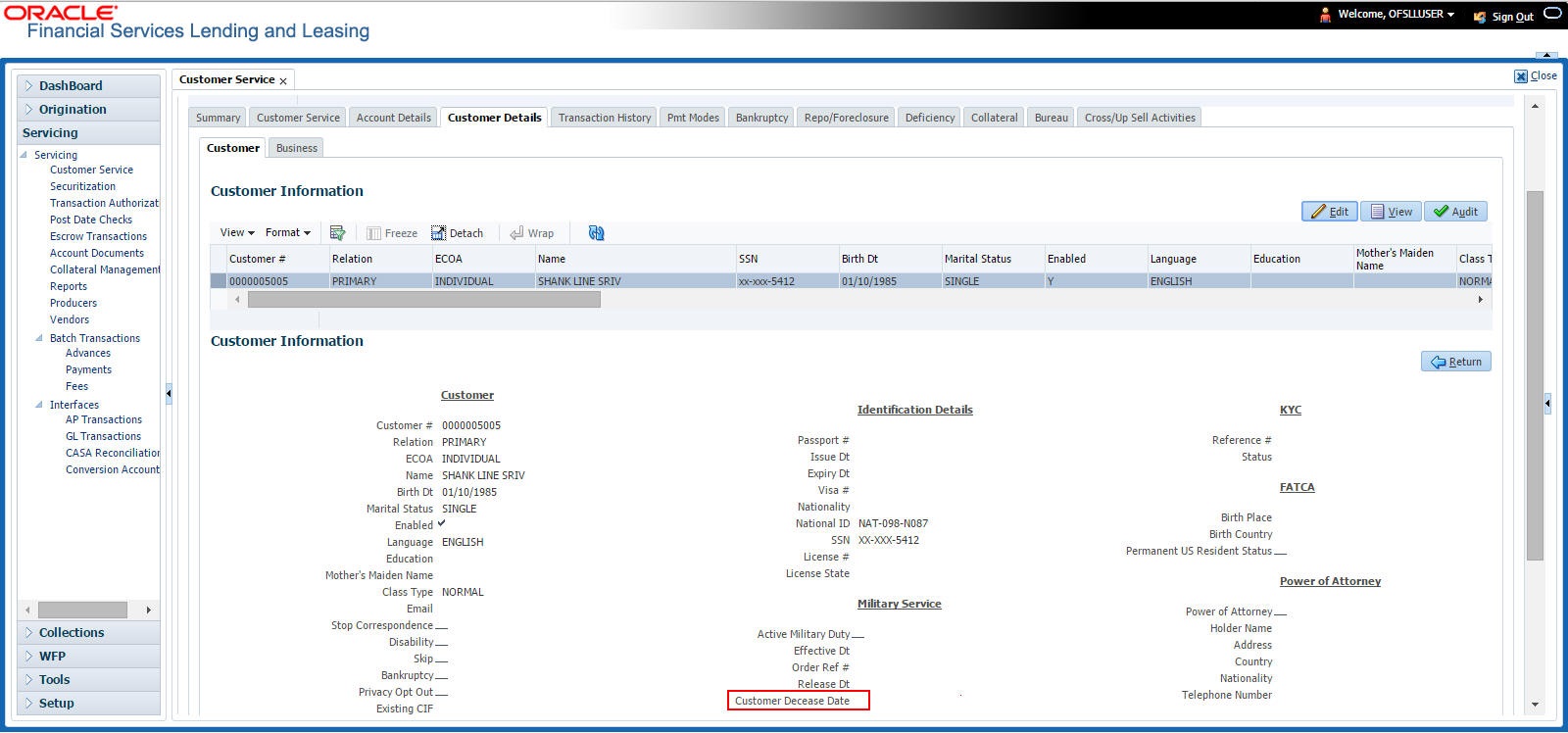

After you post this transaction, the Military Duty check box (in Account Details screen Activities section) and Active Military Duty check box (in Customer Details screen Military Service section) are de-selected. Also the release date (i.e date when released from military duty) is updated in Customer Details screen. Oracle Financial Services Lending and Leasing changes the condition of the account to OFF ACTIVE DUTY.

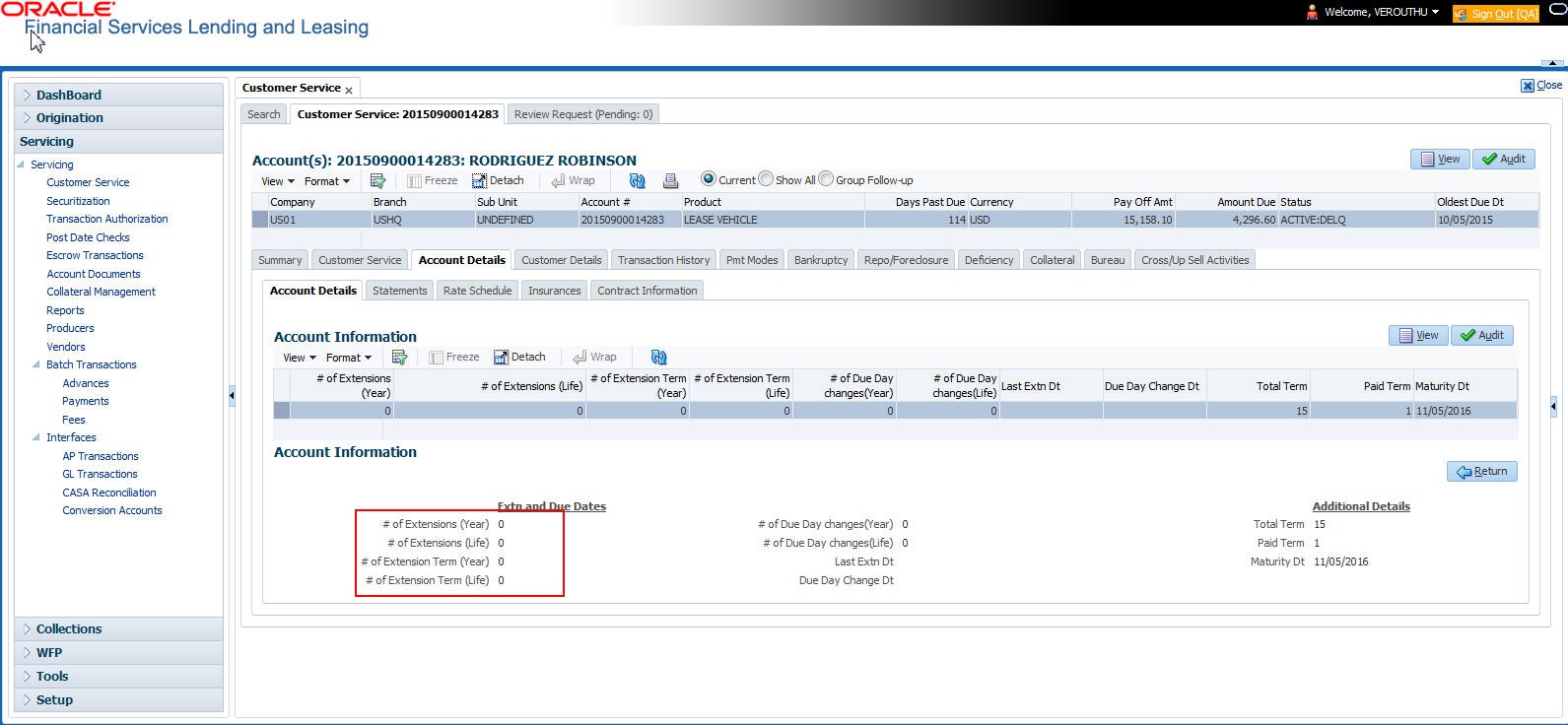

A.1.16 Due Date Change

You can change the due date of an account. When it is changed, the system determines next bill date, as well as the next due date. The DUE DATE CHANGE transaction does not allow next billing date to change such that it is less than the current billing date. The due date change transaction has been extended to change the default ACH due day, provided that the account due day and ACH due day match.

If a late fee is no longer applicable because of this due day change, Oracle Financial Services Lending and Leasing will automatically remove the fee.

The new due day appears in Activities section Due Day field on the Account Details screen.

The system also notes change on Lease Details screens in Extn and Due Dates section’s # of Due Day Changes (Year), # of Due Day Changes (Life) and Due Day Chg Dt fields.

To change a due date

Transaction |

Parameters |

Due Date Change |

Txn Date |

Due day |

|

Due Date |

|

ACH DUE DATE CHANGE |

|

PROCESS MASTER ASSOCIATED ACCOUNTS Select either Yes or No from the drop-down list. Selecting ‘Yes’ posts the transaction to Master Account and Associated Accounts and selecting ‘No’ on master account displays an error and rolls-backs all the changes. Note: System does not allow to post the transaction if this parameter is selected as NO and the Statement Consolidation option at account level is set to ‘Y’. |

|

PROCESS SAME PRODUCT TYPE AND FUNDING TYPE ACCOUNTS Select either Yes or No from the drop-down list. Selecting ‘Yes’ posts the transaction on accounts belonging to same product type and selecting ‘No’ posts the transaction to ALL accounts. |

|

CAPITALIZATION START DATE (INCLUDING GRACE DAYS) When extension is being posted on an account for which balance capitalization is enabled, select the next capitalization date from the adjoining calendar which by default includes the CAP GRACE DAYS before triggering the balance capitalization. |

|

PROCESS SAME SALES ORDER NBR ACCOUNTS If selected as ‘YES’, then transaction is automatically posted to all corresponding account(s) which are having the same Sales Order number as that of current account where this transaction is being posted. However before posting, system considers the value defined for other parameters. See section, ‘Processing with Combination of Transaction Parameters’. |

A.1.16.1 Override Due Date Change

You can override the contract ‘Due Date’ of an account to mark-up the due days limit to the required standard business rules by posting the following monetary transaction.

To override a due date change

Transaction |

Parameters |

DUE DATE CHANGE OVERRIDE |

TXN DATE |

DUE DAY |

|

DUE DATE |

|

ACH DUE DATE CHANGE |

|

PROCESS MASTER ASSOCIATED ACCOUNTS Select either Yes or No from the drop-down list. Selecting ‘Yes’ posts the transaction to Master Account and Associated Accounts and selecting ‘No’ on master account displays an error and rolls-backs all the changes. Note: System does not allow to post the transaction if this parameter is selected as NO and the Statement Consolidation option at account level is set to ‘Y’. |

|

PROCESS SAME PRODUCT TYPE AND FUNDING TYPE ACCOUNTS Select either Yes or No from the drop-down list. Selecting ‘Yes’ posts the transaction on accounts belonging to same product type and selecting ‘No’ posts the transaction to ALL accounts. |

|

CAPITALIZATION START DATE (INCLUDING GRACE DAYS) When extension is being posted on an account for which balance capitalization is enabled, select the next capitalization date from the adjoining calendar which by default includes the CAP GRACE DAYS before triggering the balance capitalization. |

|

PROCESS SAME SALES ORDER NBR ACCOUNTS If selected as ‘YES’, then transaction is automatically posted to all corresponding account(s) which are having the same Sales Order number as that of current account where this transaction is being posted. However before posting, system considers the value defined for other parameters. See section, ‘Processing with Combination of Transaction Parameters’. |

On posting the transaction system ignores the following Due Day contract parameters:

- Max Due Day Change/Yr

- Max Due Day Change/Life

- Max Due Day Change Days

- Due Day Min

- Due Day Max

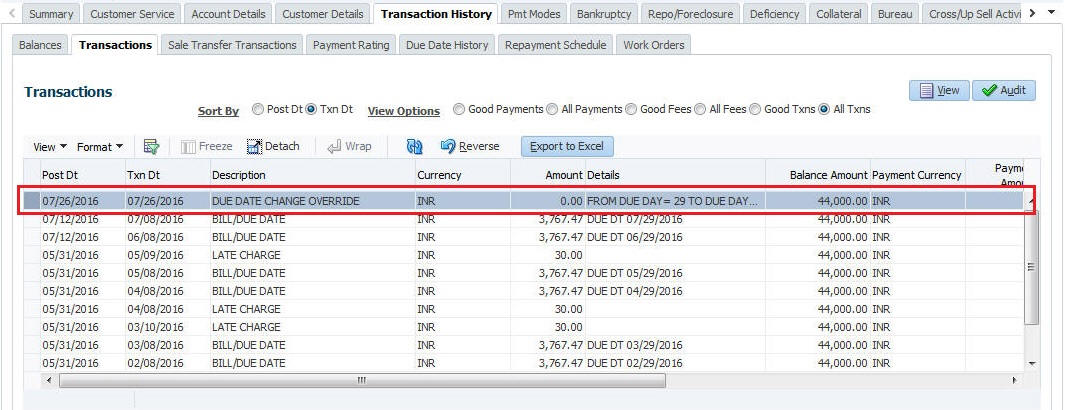

On successful posting of the transaction, system automatically increases the number on counters (i.e. number of times due date change permitted) for ‘Max Due Day Change/Yr’ and ‘Max Due Day Change/Life’. The transaction is displayed in Customer Service > Transaction History > Transactions screen.

A.1.16.2 Reverse an Override Due Date Change

When a posted ‘Due Date Change Override’ transaction contains error or non desired results, you can reverse the same in Customer Service > Transaction History > Transactions screen.

Select the Due Date Change Override transaction and click Reverse.

On successful posting of the transaction, system reverts (decreases) the change in the number on counters (i.e. number of times due date change permitted) for ‘Max Due Day Change/Yr’ and ‘Max Due Day Change/Life’.

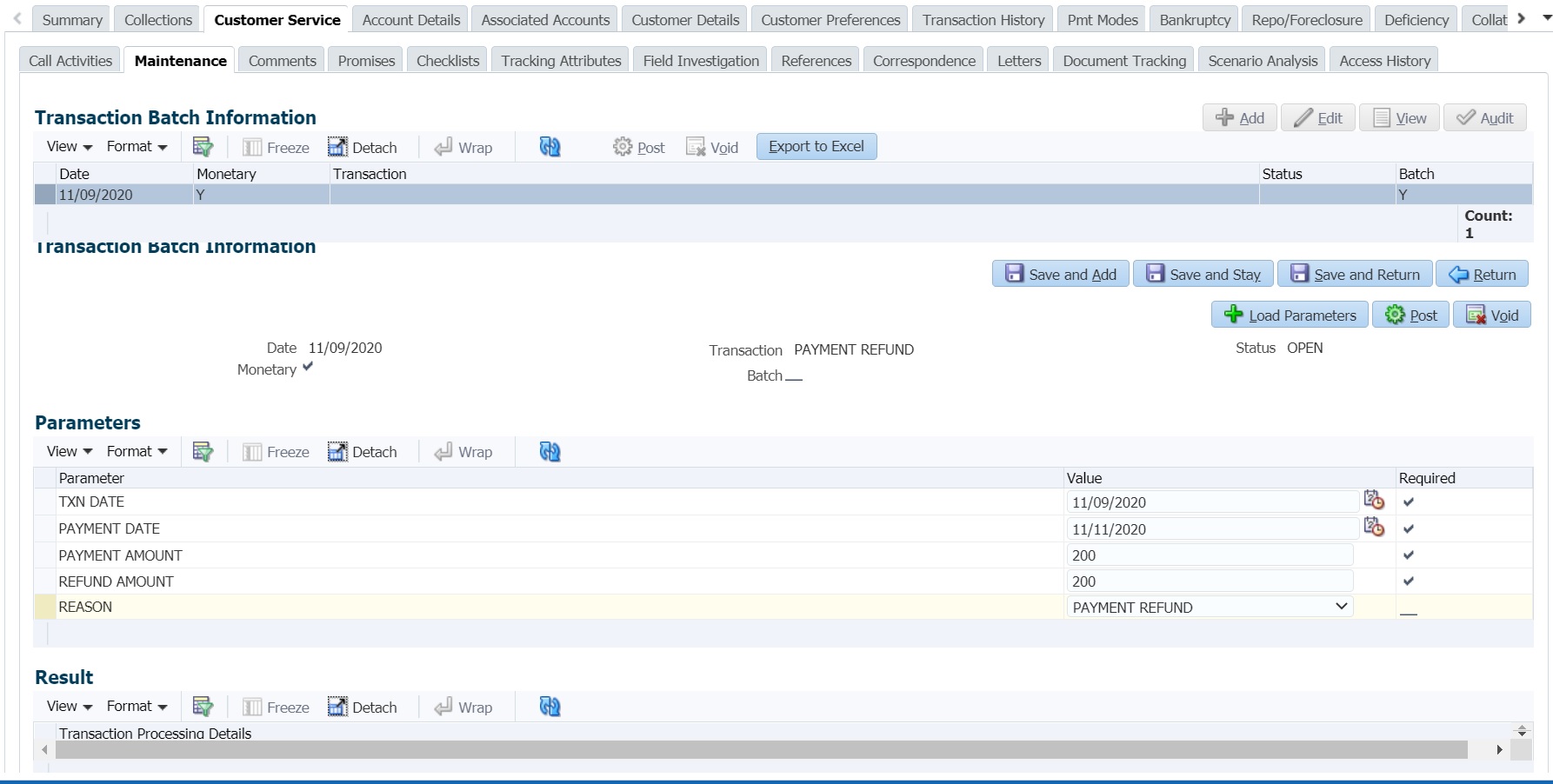

A.1.17 Payment Refund Transaction

Payment refund transactions allows you to refund excess payment received from the customer during life of the Lease. The Payment Refund transaction is posted at the maintenance screen in servicing. The refund is posted only when the refund amount is equal to Payment amount. Else an error message is displayed.

To refund the payment amount

Transaction |

Parameters |

PAYMENT REFUND (PMT_RF) |

TXN DATE Select the transaction date from adjoining calendar. |

PAYMENT DATE Select the payment posted date from adjoining calendar. |

|

PAYMENT AMOUNT Specify the payment amount received on the account. |

|

REFUND AMOUNT Specify the payment amount to be refunded. |

|

REASON Select the appropriate reason code from the drop-down list. The list is populated based on the lookup code TXN_REASON_CD (SUB CODE USED FOR REASON GROUP). |

Note that except ‘Reason’ all the other parameters are mandatory for posting payment refund transaction. However, system validates for appropriate reason code when auto-posted from Payment Maintenance screen.

On successfully posting the transaction, the payment refund details are recorded in Customer Service > Transaction History > Transactions tab.

A.1.18 Prepayment Penalty

A prepayment penalty is typically applied automatically by Oracle Financial Services Lending and Leasing if the account is paid off prematurely.

The following transactions allow you to adjust or waive the prepayment penalty fee. The adjustments will appears in the corresponding column of Customer Service screen’s Account Balances screen for fee prepayment penalty Balance Type-- Waive, Adjusted (-), or Adjusted (+) -- depending on which of the following the transactions you perform.

To adjust a prepayment penalty

Transaction |

Parameters |

Adjustment Prepayment Penalty - Add |

Txn Date Amount |

Adjustment Prepayment Penalty - Subtract |

Txn Date Amount |

To waive a prepayment penalty

Transaction |

Parameters |

Waive Prepayment Penalty |

Txn Date Amount |

A.1.19 Escrow Payment

The following monetary transactions allow you to specify escrow payment to be billed to the customer each month. Rescheduling an escrow payment enables you to change the payment rate (and hence rate and term) and define when change will begin. The “txn date” parameter is when the new agreement starts.

The following transactions allow you to adjust or waive the escrow advance.

The adjustments will appears in the corresponding column of Customer Service screen’s Account Balances screen for escrow advance Balance Type-- Waive, Adjusted (-), or Adjusted (+) -- depending on which of the following transactions you perform.

To adjust escrow advance

Transaction |

Parameters |

Adjustment to escrow advance - add |

Txn Date Amount |

Adjustment to escrow advance - subtract |

Txn Date Amount |

To waive escrow advance

Transaction |

Parameters |

Waive Escrow Advance |

Txn Date Amount |

To reschedule an escrow payment

Transaction |

Parameters |

Reschedule Escrow Payment |

Txn Date Amount |

A.1.20 Escrow balance refund

If an account is paid off resulting in a positive (greater than $0) escrow balance or the last item being escrowed is removed resulting in a positive (greater than $0) escrow balance, then Oracle Financial Services Lending and Leasing refunds the escrow and creates a check requisition.

A.1.21 Pay Off Quote Fee

The PAYOFF QUOTE transaction on Maintenance screen includes the required parameter ASSESS PAYOFF QUOTE FEE. If you select Y, Oracle Financial Services Lending and Leasing assesses a payoff quote fee on Customer Service form’s Balances screen for Balance Type FEE PAYOFF QUOTE. The amount of the payoff quote fee is based on contract setup.

The following transactions allow you to adjust or waive the pay off quote fee.

The adjustments will appears in the corresponding column of Customer Service form’s Balances screen for FEE PAYOFF QUOTE Balance Type-- Waive, Adjusted (-), or Adjusted (+) -- depending on which of the following transactions you perform.

To adjust a pay off quote fee

Transaction |

Parameters |

Adjustment to Payoff Quote Fee - Add |

Txn Date Amount |

Adjustment to Payoff Quote Fee - Subtract |

Txn Date Amount |

To waive a pay off quote fee

Transaction |

Parameters |

Waive Payoff Quote Fee |

Txn Date Amount |

A.1.22 Nonperforming Accounts

Lease accounts can be placed in a nonperforming, or nonaccrual, condition. Once an account is set to a nonperforming condition, the system makes the following modifications and accounting entries:

- After the transaction date, Oracle Financial Services Lending and Leasing assesses no late charge to this account.

- Stops general ledger entries for interest accrual.

- Transfers the existing principal balance on this account to the Non-Performing Balance Group on Customer Service form’s Balance screen.

- Charges the unearned dealer compensation back to the dealer.

- Treats payments posted to this account as it does with a normal account; however, the general ledger entries for allocation of these amounts towards principal and interest will go towards the nonperforming balance.

The system’s general ledger (GL) is set up for the above items. There will be no impact on balances of the account (principal, interest, fee and expense) as a result of the above transactions.

To place an account in a nonperforming condition

Transaction |

Parameters |

Account Non Performing |

Txn Date |

Non Performing Description |

The following transaction removes nonperforming condition on an account and reverses the nonperforming transactions explained above. General ledger entries for interest accrual, stopped during nonaccrual stage, resume.

To reverse a nonperforming condition

Transaction |

Parameters |

Resume Account Performing |

Txn Date |

A.1.23 Convert a Precomputed (PC) Lease into a Simple Interest (SI) Lease

When converting a precomputed Lease into a simple interest Lease, Oracle Financial Services Lending and Leasing assumes the following default values:

- Accrual Calculation Method - interest bearing (simple interest)

- Maturity Date - Computed from the term and next payment due date

- Monthly Payment Amount - Computed from the interest rate, new principal balance, accrual start date, and term.

- All balances other than the Note balance are carried over to simple interest Lease.

The resulting ‘new’ simple interest Lease will have the same account number with details entered/computed above.

Caution: The converting a precomputed Lease into a simple interest Lease transaction can be performed only by closing the nonperforming condition.

To reschedule precomputed Lease to interest bearing Lease

Transaction |

Parameters |

Reschedule Pre-Compute Lease to Interest Bearing Lease |

Txn Date |

Reschedule Payment Start Date |

|

Amount |

|

Rate |

|

Term |

A.1.24 Account Settlement Transaction

A delinquent account can be settled when the lender agrees for a specific 'settlement amount' with the borrower. Here the 'settlement amount' is the net amount agreed for settlement between both the parties. If the borrower makes that payment within the 'Good through date', lender would consider that corresponding account is paid off / closed even if actual payment is less than the actual outstanding balance.

Note that, system does not allow to post account settlement transaction on 'Charged Off' accounts. Similarly when ‘Account Settlement Transaction’ is in force, system does not allow to charge-off the account.

To post an account settlement transaction

Transaction |

Parameters |

ACCOUNT SETTLEMENT |

TXN DATE |

EFFECTIVE DATE |

|

GOOD THROUGH DATE |

|

AGREED SETTLEMENT AMOUNT |

|

COMMENT |

Here, the transaction date can be back dated but the effective Date for the settlement need to be the current date or a future date.

On posting the transaction successfully, the new account condition 'Account Under Settlement' is updated with end date as 'Good Through Date'.

- On 'Good Through Date' if the settlement amount is partially or not honoured, system automatically closes the ‘Account Under Settlement’ condition posted on the account and also remove the settlement details posted on the account.

- In case the entire settlement amount is received on or before the 'Good Through Date', on executing the ‘Account Settlement Processing’ batch on that day, system closes the ‘Account Under Settlement’ condition. The 'Settlement Information' in Customer Service Summary screen and Account Details screen is retained to indicate the last settlement information that lead to the PAIDOFF status of the account.

- 'Paid Off' transaction is automatically posted so that account balance will be updated as zero.

- System ignores the Write-off Tolerance amount to post Paid-Off transaction and outstanding balances will be waived.

The 'Settlement Information' is updated in following screens:

- Customer Service > Summary > Account Details > Settlement Information

- Customer Service > Account Details'

If required, this settlement monetary transaction can also be reversed from the 'Payment Maintenance' screen by clicking the 'Reverse' button.

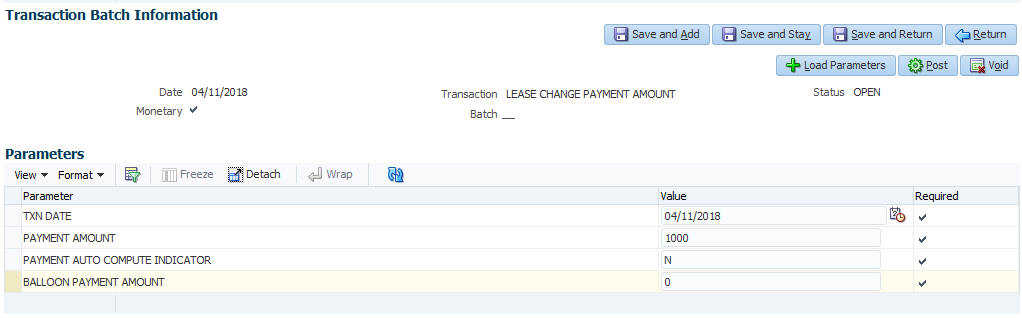

A.1.25 Change Lease Payment Amount

During the servicing stage of lease account, you can change the payment amount by posting ‘LEASE CHANGE PAYMENT AMOUNT’ monetary transaction and generate new repayment schedule. However, note that changing the payment amount is supported only for ‘Interest Rate’ type of lease calculation method.

While posting this transaction, you can either allow system to auto compute the new payment amount or specify the new payment amount for reschedule.

- To auto compute the new payment amount, specify the value of ‘Payment Auto Compute Indicator’ parameter as ‘Y’. System ignores the other parameter values if specified in ‘Balloon Payment Amount’ or ‘Payment Amount’.

- Else, specify the value of ‘Payment Auto Compute Indicator’ parameter as ‘N’ and enter the value for new ‘Payment Amount’. Here system validates the value in ‘Balloon Payment Amount’ and displays an error indicating that ‘Balloon amount should be zero for override payment change’.

To change the payment amount

Transaction |

Parameters |

CHANGE PAYMENT AMOUNT |

TXN DATE |

PAYMENT AMOUNT |

|

PAYMENT AUTO COMPUTE INDICATOR |

|

TERM |

|

BALLOON PAYMENT AMOUNT |

On successful posting of the transaction, a letter of intimation is generated for correspondence by the scheduled batch LCSTXN_BJ_121_01 (LETTER FOR LEASE MONETARY TXNS) which consists of rescheduled lease contract terms indicating Transaction Date, old and new Payment Amount and Balloon Payment Amount.

You can also reverse the payment amount change and revert the payment to old amount. If there are any payment(s) received before reversal, the same is adjusted to due buckets accordingly. However, on reversal letter is not generated and has to be manually intimated.

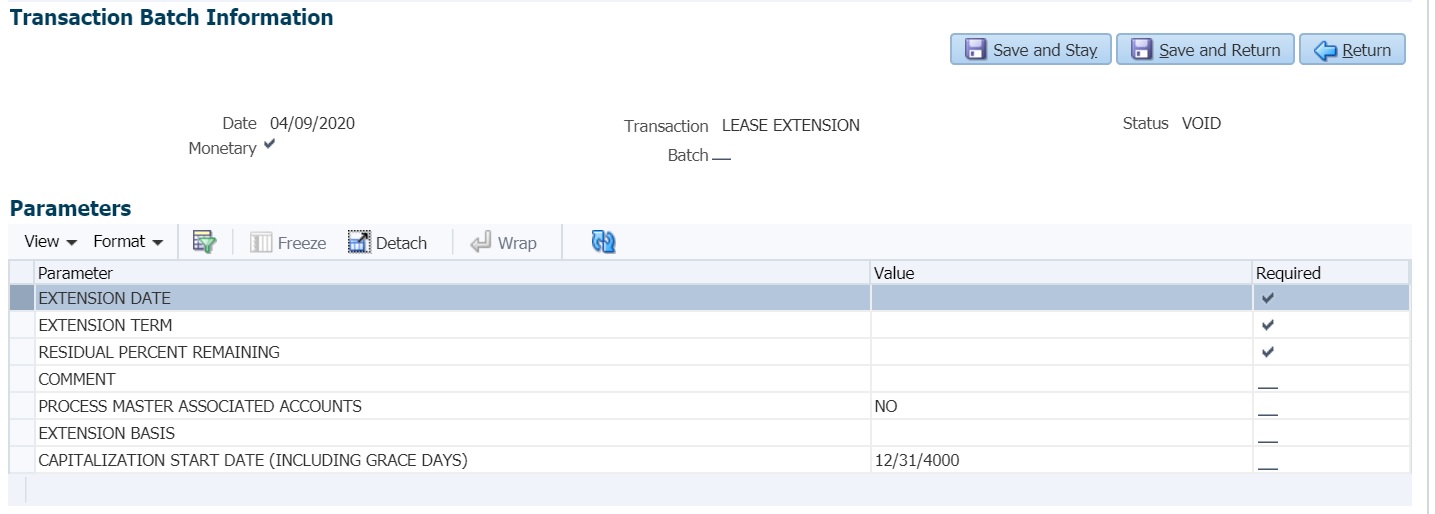

A.1.26 Lease Extension

During the lease period or after the end of a lease term, you can extend the lease contract by posting ‘LEASE EXTENSION’ transaction. Based on the transaction posting date i.e. either on or before the current maturity date, the lease term is extended immediately and a comment is posted on the account indicating ‘Term extended before/after maturity date’.

Lease extension is allowed within and up to the current available residual % value of the asset and is validated against the following extension limits (values) defined in Setup > Contract screen before allowing for extension.

- Max Extn Period / Life

- Max # Extn /Life

- Minimum # Payments

Note that, lease extension is allowed only for ‘Interest Rate’ type of lease calculation method and for accounts in active status. However, lease extension is not allowed in the following conditions:

- If residual value is already included in final statement

- If extension posting date is before the maturity date

- If 'Estimated Life' of asset is less than extension period

- If the residual value is ZERO

To extend lease contract

Transaction |

Parameters |

LEASE EXTENSION |

EXTENSION DATE |

EXTENSION TERM |

|

RESIDUAL PERCENT REMAINING |

|

COMMENT |

|

PROCESS MASTER ASSOCIATED ACCOUNTS Select either Yes or No from the drop-down list. Selecting ‘Yes’ posts the extension transaction to Master Account and Associated Accounts and selecting ‘No’ posts extension only to current account. |

|

EXTENSION BASIS Select one of the following option as the basis for posting the extension from the drop-down list. OLDEST DUE DATE -To post extension considering the oldest unpaid due date. Any paid due buckets is not altered and original due dates are retained. UNPAID DUES - To post extension considering only the unpaid due buckets. Here the unpaid due dates are moved by adding the terms represented in the transaction. Unpaid dues are those for which Payment = N in Due Date History and may also include the partially paid amount (i.e. paid amount - tolerance amount). |

|

CAPITALIZATION START DATE (INCLUDING GRACE DAYS) When extension is being posted on an account for which balance capitalization is enabled, select the next capitalization date from the adjoining calendar which by default includes the CAP GRACE DAYS before triggering the balance capitalization. |

While posting the above transaction, specify the current transaction posting date in Extension date, duration of extension in Extension Term, the percentage of residual value is being utilized for extension in Residual Percent Remaining and additional information or justification for extension in Comment. System validates and displays an error if the residual percent remaining does not match with system maintained data.

On successful posting of transaction, new maturity date is updated on the account and new repayment schedule is generated. Also the counters in Account Details and Summary screen are updated.

A letter of intimation is generated for correspondence by the scheduled batch LCSTXN_BJ_121_01 (LETTER FOR LEASE MONETARY TXNS) which consists of Extension Date, First Pmt Date, Term, Lease Expiry Date, and Residual %.

You can also reverse the lease extension and system automatically reverses the bills generated after the old maturity date. However, on reversal letter is not generated and has to be manually intimated.

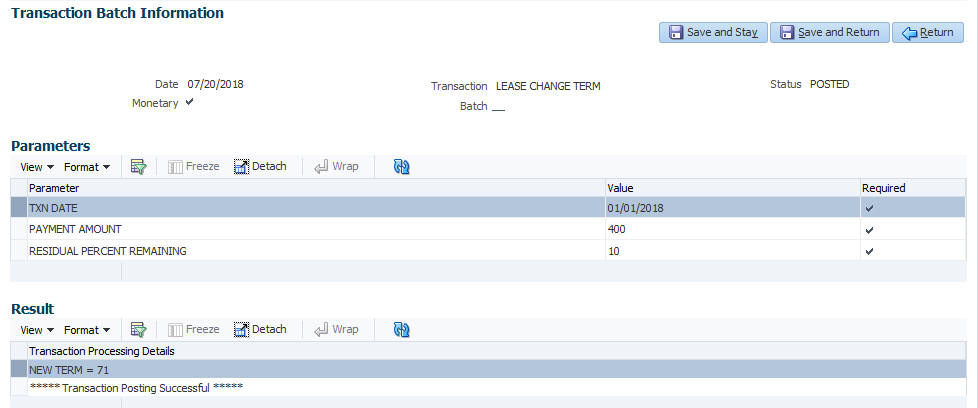

A.1.27 Change Lease Term

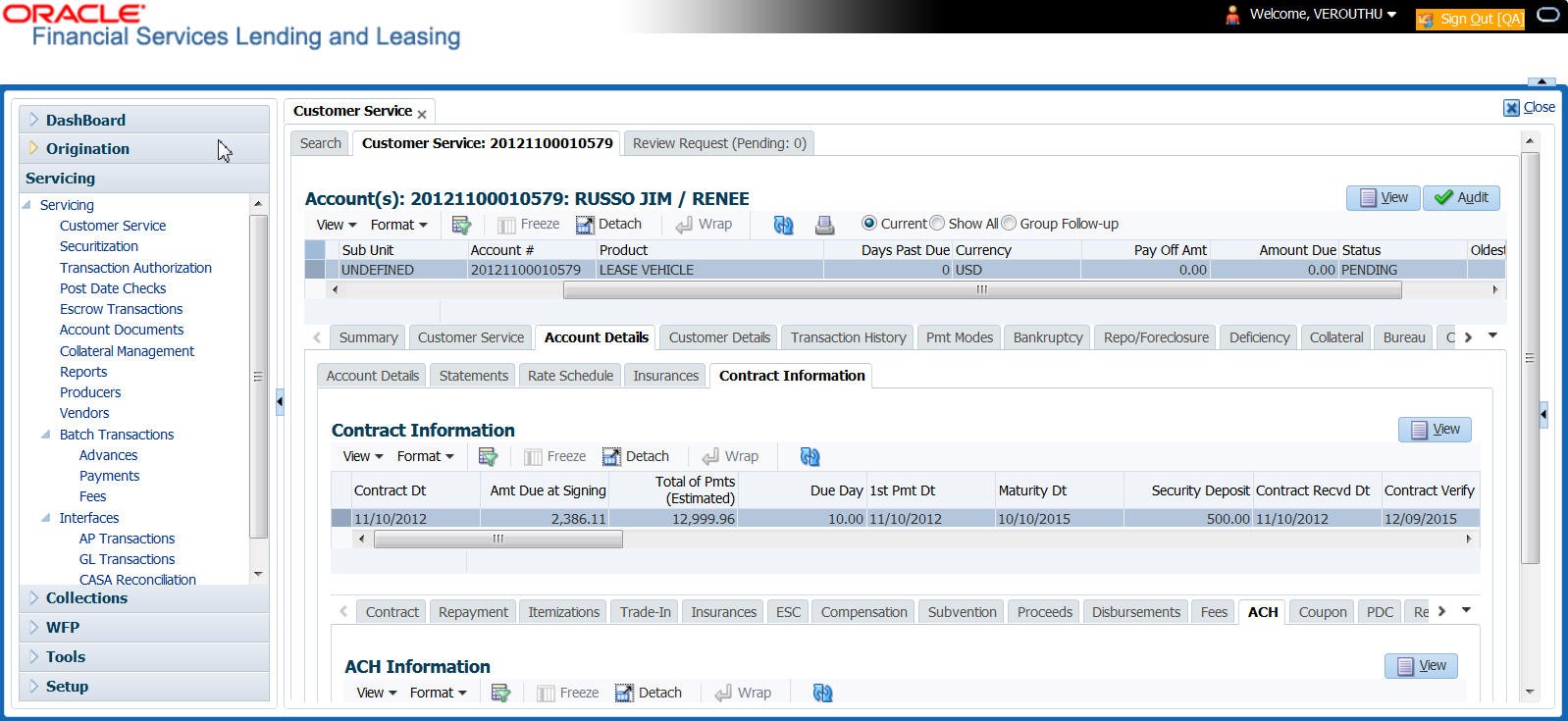

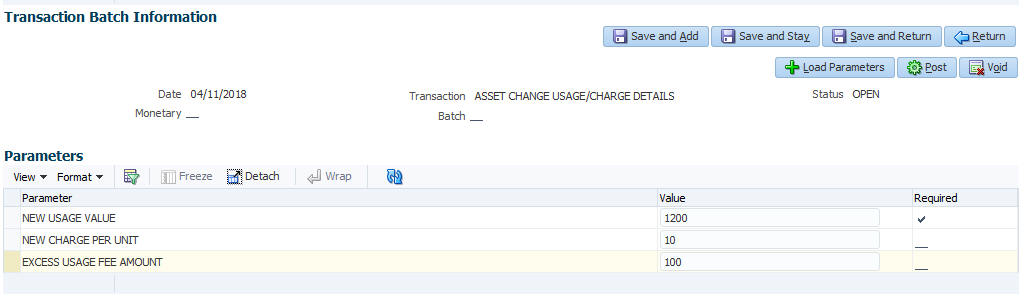

During the lease period, you can change the maturity date of a lease account and either increase or decrease the lease term by posting ‘LEASE CHANGE TERM’ transaction in Customer Service > Maintenance > Transaction Batch Information section.

‘LEASE CHANGE TERM’ transaction can either be a future or backdated and depends on the payment amount and residual percentage of remaining amount.

Note

The option to change lease term is allowed only for ‘Interest Rate’ type of lease calculation method and for accounts in active status. However, changing lease term does not impact delinquency status of the account except for back dated transactions.

To change lease term

Transaction |

Parameters |

LEASE CHANGE TERM |

TXN DATE |

PAYMENT AMOUNT |

|

RESIDUAL PERCENT REMAINING |

While posting the above transaction,

- Specify the current transaction posting date in Txn Date field. You can also post a backdated transaction by specifying a previous date but not beyond first the billing date.

- Specify the payment amount and the percentage of remaining residual amount as indicated below:

- To decrease lease term, the payment amount should be greater than the billing amount and residual % should be greater than the system maintained data.

- To increase lease term, the payment amount should be lesser than the billing amount and residual % should be lesser than the system maintained data.

However, lease term can also be changed by maintaining the residual % as zero.

On successfully posting the transaction, the new lease term is calculated between 'Due Dt Next' and 'New Maturity Dt' and is displayed in the ‘Results’ section. Also the new term and other details are updated on the account and new repayment schedule is generated.

The following screens are updated with lease term change:

- Servicing > Customer Service > Scenario Analysis tab

- Servicing > Customer Service > Transaction History > Transactions tab, ‘Details’ column is updated with new lease term.

- Servicing > Customer Service > Transaction History > Repayment Schedule tab, the repayment schedule details are updated.

- Servicing > Customer Service > Summary screen > Account Details > Dues section, the ‘Remaining Term', 'Paid Term' and 'Amt Paid Excess' fields are updated.

- Servicing > Customer Service > Summary screen > Account Details > Account Information section, the ‘Term' and 'Maturity Dt' fields are updated.

- Servicing > Account Details > Account Information section, the following fields are updated - 'Depreciation Value', 'Residual Value', 'Residual %', 'Rent Charge', 'Billed Term', 'Total Term', 'Paid Term' and 'Maturity Dt'.

You can also reverse this transaction in Transaction History > Transactions tab and system automatically reverses the bills generated (if any) post the lease term change.

A.1.28 Lease Security Deposit Adjustment

As part of the collection activity, the security deposit amount paid upfront during the lease contract can be used to adjust the arrears on the account by posting the ‘Security Deposit Adjustment’ transaction.

To Adjust Lease Security Deposit

Transaction |

Parameters |

SECURITY DEPOSIT ADJUSTMENT |

TXN DATE |

AMOUNT (should be less than or equal to security deposit amount) |

|

COMMENT |

Before posting the transaction, ensure that the security deposit balance is adequate to adjust the arrears. Else, system displays a validation error indicating 'Insufficient Security Deposit' amount to adjust'.

On posting the transaction, system adjusts the balances based on either spread matrix or the spread defined at contract. On successful posting of transaction, the ‘Security Deposit’ amount is adjusted on the account as a payment and ‘Late Fee’ (if any) will be eligible for reversal. The ‘Results’ section displays the status of transaction and indicates previous and current Security Deposit Amount on the account.

A letter of intimation is generated for correspondence by the scheduled batch LCSTXN_BJ_121_01 (LETTER FOR LEASE MONETARY TXNS) which consists of Transaction Date, Security Deposit Amount before and after adjustment, and comments if any.

You can also reverse the security deposit adjustment by posting ‘Security Deposit Adjustment Reverse’ transaction and system automatically reverses the balance of transaction amount to the ‘Security Deposit Amount’. However, on reversal letter is not generated and has to be manually intimated.

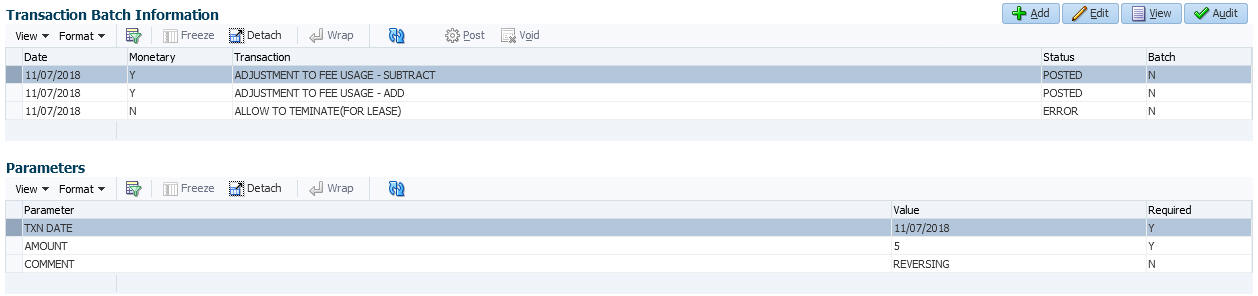

A.1.29 Lease Fee Usage Adjustments

After calculating the lease fee usage if there are any differences which needs to be corrected (increase/decreased) to the fee usage amount, you can post the following two types of lease transactions to adjust fee usage balance accordingly.

- Adjustment to Fee Usage - ADD

- Adjustment to Fee Usage - SUBTRACT

To Add Lease Fee Usage

Transaction |

Parameters |

ADJUSTMENT TO FEE USAGE - ADD |

TXN DATE |

AMOUNT (Fee Usage amount that needs to be added) |

|

COMMENT |

To Subtract Lease Fee Usage

Transaction |

Parameters |

ADJUSTMENT TO FEE USAGE - SUBTRACT |

TXN DATE |

AMOUNT (Fee Usage amount that needs to be subtracted) |

|

COMMENT |

For more information on how OFSLL handles lease calculation and billing, refer to APPENDIX - Usage Based Leasing chapter.

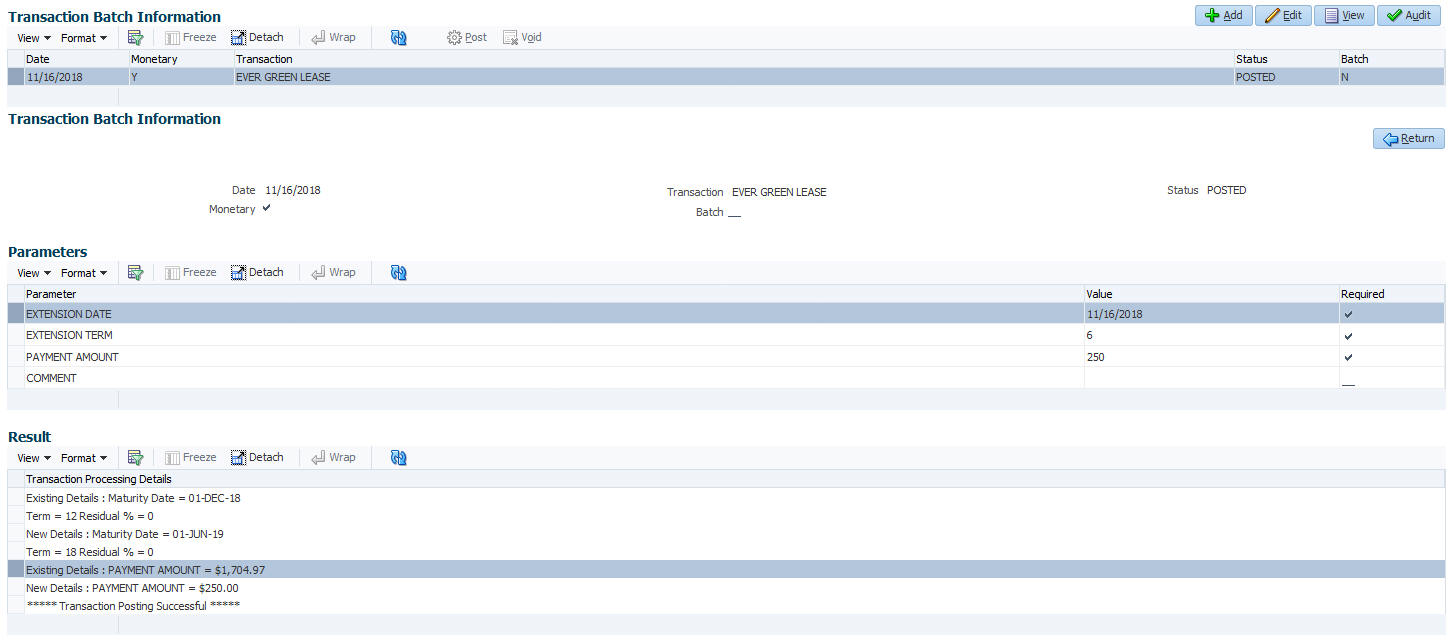

A.1.30 Evergreen Lease Transaction

Evergreen lease in OFSLL refers to a type of lease contract between customer and financial institution in which the customer can use an asset which is still in working condition and agrees to pay a minimum lease amount for a specific term, even if the residual value of asset becomes zero.

This lease amount is a mutually agreed value by both the parties and does not specifically include depreciation cost of asset or the interest component.

For example, if an Evergreen Lease contract is agreed for Lease Payment Amount of $5 and Term of 36 months, the billing is done for lease receivables as follows:

Cycle |

Lease Receivable without Payment |

Lease Receivable with Monthly Payment |

Term |

Remaining Term |

0 |

0 |

0 |

0 |

36 |

1 |

5 |

5 |

1 |

35 |

2 |

10 |

5 |

2 |

34 |

3 |

15 |

5 |

3 |

33 |

N |

N x Lease Payment Amount |

Lease Payment Amount |

4 |

32 |

Similar to any other lease contract, even in Evergreen Lease the customer is billed for the agreed payment amount until the lease maturity date and lease receivable is updated based on the billing. Other transactions such as late fee, lease payoff and termination are processed as usual.

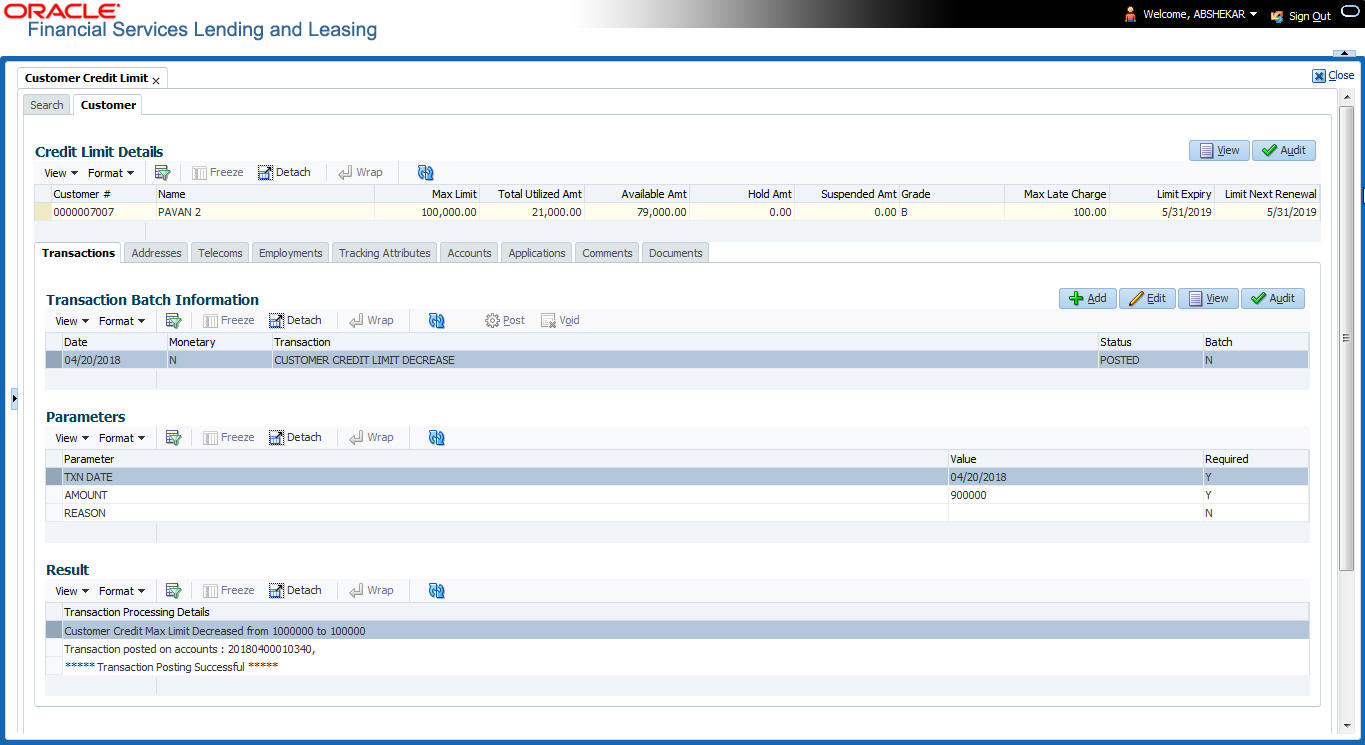

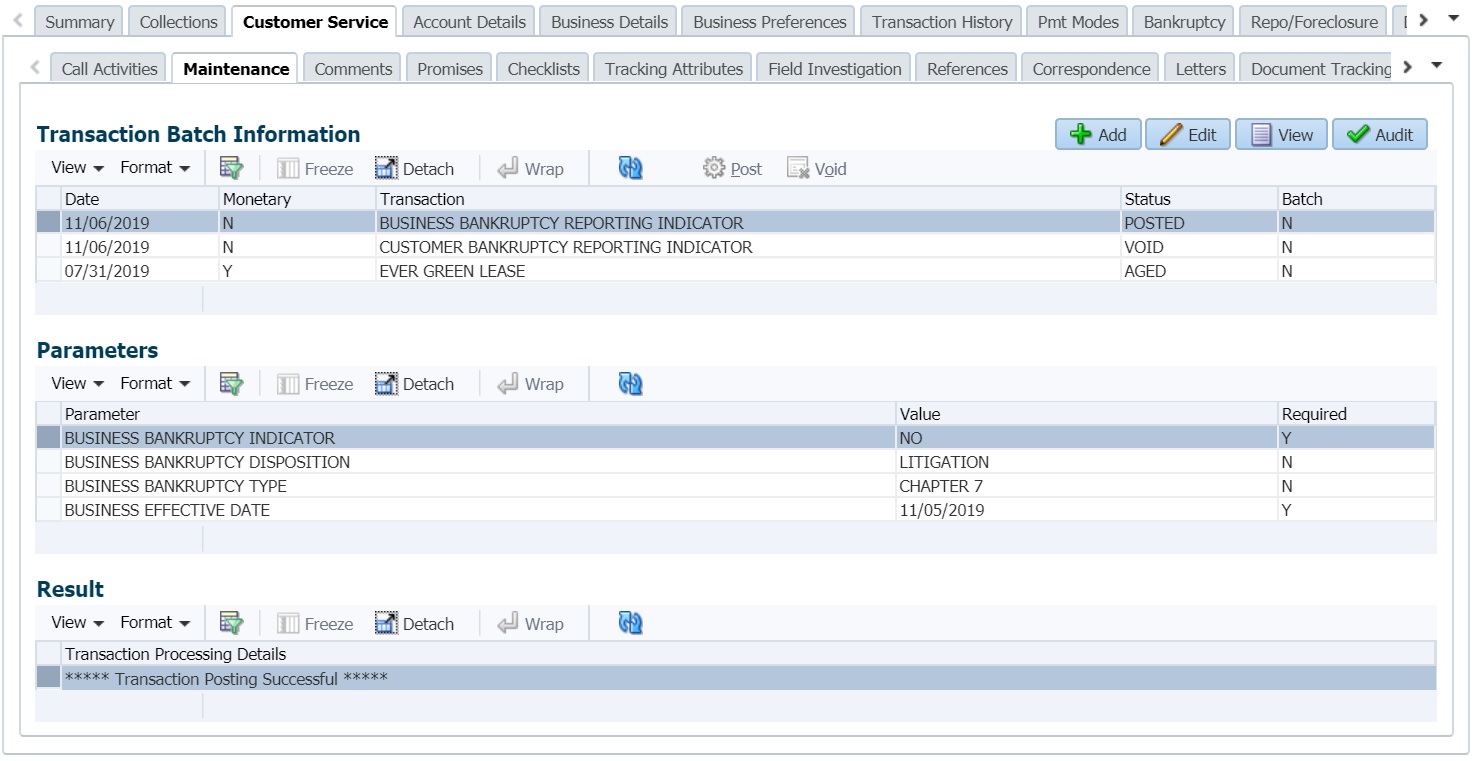

You can define Evergreen Lease contract in OFSLL by posting EVER GREEN LEASE monetary transaction in Servicing > Customer Service > Maintenance screen at anytime i.e. Before / On / After the account maturity date.

Note

Evergreen Lease in OFSLL is supported only for INTEREST RATE type of lease calculation method.

If evergreen lease transaction is posted on existing lease account, the lease account is extended up to the term specified and is billed as per the agreed ‘Payment Amount’ for extended term. Also the ‘Rate’ and ‘Residual %’ of the existing lease are updated to ‘0’ and existing balances are closed by either posting an adjustment minus transaction to the account or collecting the payment from customer.

To post ever green lease transaction

Transaction |

Parameters |

EVER GREEN LEASE |

EXTENSION DATE |

EXTENSION TERM |

|

PAYMENT AMOUNT |

|

COMMENT |

While posting the above transaction,

- Specify the extension date as either current transaction posting date or a future date. However, system does not allow to post a backdated transaction.

- Specify the extension term which is agreed term between customer and financial institution.

- Specify the payment amount which is rental amount for asset usage.

- Specify additional details (if any) in comment field.

On successfully posting the transaction, the ‘Results’ section displays the details of old and new Maturity Date, Term, Payment Amount and the Residual % is set as zero. The lease receivables are updated with new amount (calculated as New Payment Amount x Term) in Servicing > Balances tab and new repayment schedule is generated. A new Evergreen lease condition is posted on the account.

You can also reverse the Evergreen Lease Transaction in Servicing > Customer Service > Transaction History tab and system automatically reverses the Payment Amount, Term and other existing lease contract details (if any).

System restricts posting the following transactions after posting evergreen lease transaction:

- Lease Change Term transaction - LS_CHANGE_TERM

- Lease Extension transaction - LS_EXTENSION

- Lease Change Payment Amount transaction - LS_CHANGE_PMT_AMT

- Business Credit Limit Maintenance transaction - BUS_CRLMT_MAINT

- Lease SCRA transaction - CUST_ON_MLTRY_DUTY

- Index / Margin Rate Change transaction - RESCHEDULE_INDEX

- Customer Credit Limit Maintenance transaction - CUS_CRLMT_MAINT

- Rate Change transaction - RATE_CHANGE

The following screens are updated on posting Evergreen Lease transaction:

- Servicing > Customer Service tab, the details of 'Days Past Due', 'Pay Off Amt', 'Amount Due', ' Status' and 'Oldest Due Dt' fields are updated and the amount fields are reset to ‘0’.

- Servicing > Summary screen changes:

- Conditions section - Account Condition, Condition Start Dt, and Followup Dt fields are updated.

- Account Details > Dues section - fields are reset to zero, term and other fields are updated accordingly.

- Delinquency Information section - details are cleared since there is no delinquency and balances are written-off.

- Account Information section - the Contract Dt, Adjusted Cap Cost, Term, Rate and Maturity Dt fields are updated.

- Servicing > Account Details > Account Information, the 'Rent Charge' and Additional Details section fields - Total Term, Paid Term and Maturity Dt are updated.

- Servicing > Customer Service > Scenario Analysis tab, Term, Payment Amount and other details are auto populated.

- Servicing > Customer Service > Transaction History tab changes:

- Transactions tab - Description, Amount and Term fields are updated.

- Repayment Schedule tab is updated with new schedule based on term.

- Due Date History tab - existing details (dues) are cleared and new record is created only after first billing.

A.1.31 Lease Rental/Damage Fee Adjustments

After calculating the lease rental fee if there are any rental adjustments or charge which needs to be posted to the account balances (Contract setup > Balances sub tab), you can post the following types of lease monetary transactions.

- ADJUSTMENT TO RENTAL CHARGE - ADD

- ADJUSTMENT TO RENTAL CHARGE - SUBTRACT

- ADJUSTMENT TO DAMAGE CHARGE - ADD

- ADJUSTMENT TO DAMAGE CHARGE - SUBTRACT

To post the above transactions

Transaction |

Parameters |

ADJUSTMENT TO RENTAL/DAMAGE CHARGE - ADD/SUBTRACT |

TXN DATE |

AMOUNT (amount that needs to be updated) |

|

COMMENT |

For more information on how OFSLL handles Rental calculation and billing, refer to ‘Rental Agreement’ section in Origination User Guide.

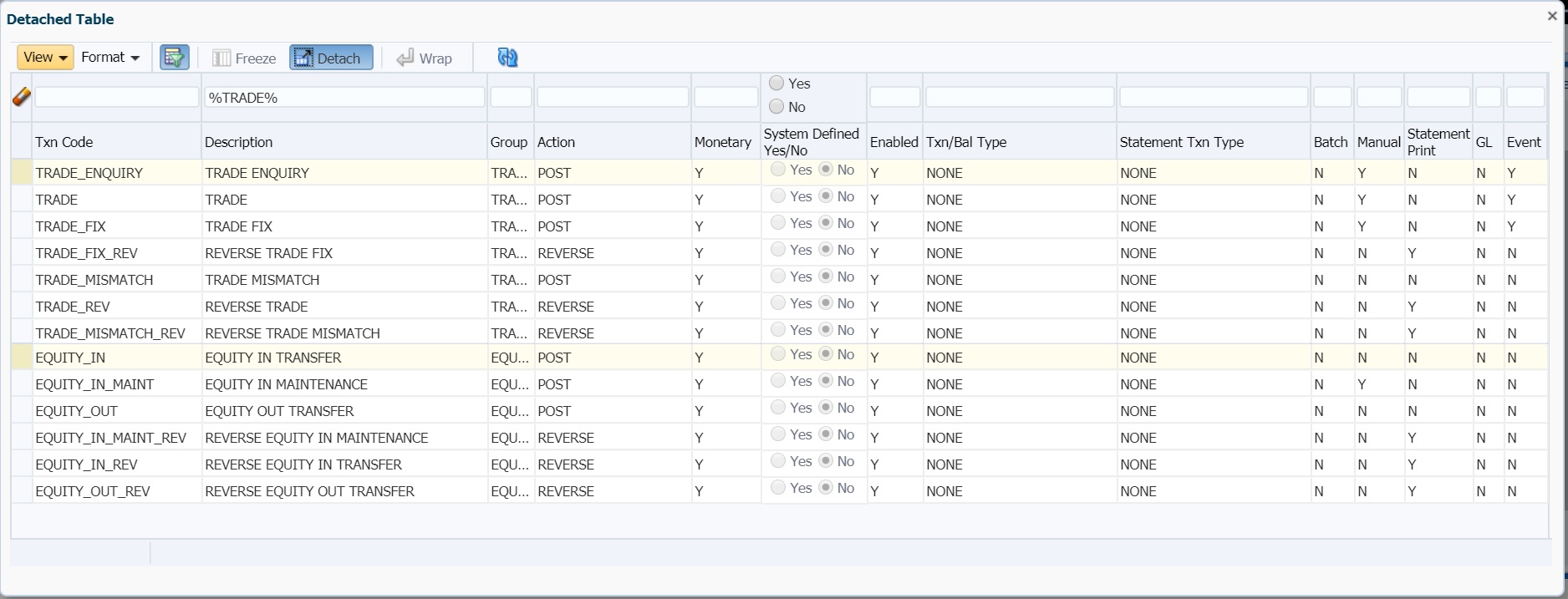

A.1.32 Trading of Accounts - Monetary Transactions

Following are the monetary transactions involved while processing Trading of Accounts. These processes are either posted automatically by external origination system or need to be posted manually in Servicing > Customer Service > Maintenance screen. For information about how Trading of Accounts is processed in OFSLL, refer to ‘Trading of Accounts’ chapter.

- Trade Enquiry Transaction

- Trade Transaction

- Equity Out Transfer Transaction

- Equity In Transfer Transaction

- Trade Fix Transaction

- Equity in Maintenance Transaction

- Account Charge Off

A.1.32.1 Trade Enquiry Transaction

Trade Enquiry monetary transaction is posted by external origination system to validate if an Account can be traded. This transaction provides details of total available Equity of an Account for a Specific Validation Date. However, the Trade Amount computation is configurable using User Defined Parameters defined in Setup > Administration > User Defined Parameters screen.

To post Trade Enquiry transaction

Transaction |

Parameters |

TRADE ENQUIRY |

TXN DATE |

TRADE ENQUIRY VALID UPTO DATE |

|

TRADE ENQUIRY LTR PRINT |

|

COMMENT |

While posting the transaction,

- If TRADE ENQUIRY VALID UPTO DATE is specified, then system calculates Accrued Interest on account till the date specified.

- If TRADE ENQUIRY LTR PRINT is selected as ‘YES’, then a Trade Enquiry Letter with specific format is generated. The value of parameters in the letter are fetched from variables defined in the configuration.

On posting this transaction, system displays the response based on configurable calculation parameter definition defined for ‘Trade Equity’ (ACC_EQUITY_AMT) in User Defined Parameters screen. Only those definitions with valid selection criteria are consider for processing.

On processing the transaction, the Result section displays the following information:

- A set of pre-defined details such as:

- ACCOUNT NUMBER

- MASTER ACCOUNT NUMBER (if associated)

- ACCOUNT CURRENCY

- System derived values from User Defined Parameters configuration > Formula Variables.

- System derived interest value if the definition contains Accrued Interest as Formula Variable which is calculated based on TRADE ENQUIRY VALID UPTO DATE as similar to payoff quote.

- System derived final composite Trade Equity value and displays based on the description provided for Target Parameter.

On successful posting the transaction, a comment is posted on the Account indicating ACCOUNT TRADE EQUITY PROVIDED TO FOR AMOUNT USD <AMOUNT> VALID UPTO <DATE>.

A.1.32.2 Trade Transaction

Trade monetary transaction is posted by external origination system to Trade and transfer equity from an existing (old) Account to new Account. This transaction implicitly posts Equity-In transfer and Equity-Out transfer transactions on new and old accounts respectively.

Following are the different types of Trade transactions supported:

Type |

Description |

Upgrade |

In this case, one existing (old) Account is upgraded to new Account. |

Split |

In this case, one existing (old) Account is upgraded to multiple new Accounts. |

Combine |

In this case, multiple old Accounts are upgraded to one new Account. |

To post Trade transaction

Transaction |

Parameters |

TRADE |

TXN DATE |

PROCESS MASTER ACCOUNT |

|

PROCESS LINKED ACCOUNT |

|

VALIDATE COMMON CUSTOMER |

|

COMMENT |

While posting the transaction,

- If PROCESS MASTER ACCOUNT is selected as ‘YES’, then Trade transaction is automatically posted to corresponding Master Account.

- If PROCESS LINKED ACCOUNT is selected as ‘YES’, then Trade transaction is automatically posted to corresponding Linked Accounts.

- If VALIDATE COMMON CUSTOMER is selected as ‘YES’, then system validates for a common customer between existing (old) and new account. If not, displays an error.

Note the following:

- Before processing actual trade transaction, Trade Equity is computed and updated in ACC_EQUITY_AMT.

- If Trade transaction is posted on Accounts where Trade Equity is zero, then system considers those as ‘Non-Equity Based’ accounts.

- As part of Trade process if Trade Eligible flag is set to ‘N’ for an Asset, then that particular Asset Status is marked as ‘ACTIVE’. Else, asset status is updated to INACTIVE.

Trade transaction will be posted ‘Only if’ the resultant value of following 3 are similar:

- Sum of Equity in itemization of new Accounts

- Sum of Trade Equity of existing (old) Accounts

- Sum of Equity Transfer Amount in Trade Details

In case of mismatch in any one of above, Trade transaction is not posted and instead TRADE MISMATCH transaction is automatically posted by the system with same transaction parameters on the existing (old) account along with a condition - EQUITY MISMATCH DURING TRADE.

In addition,

- During the Trade transaction, a linked ‘Equity Out Transfer Transaction’ is posted on existing (old) Account to transfer Equity to new account.

- Adjustment minus transaction is posted for all open balances on traded (old) Account to mark the outstanding amount as zero.

On successfully posting of Trade transaction,

- A Comment is posted on existing (old) account in the format ACCOUNT TRADED ON <DATE> WITH TOTAL TRADE EQUITY <VALUE> WITH <TRADE FIX REASON> AND <COMMENT>

- Account status is updated as TRADED.

A.1.32.3 Equity Out Transfer Transaction

‘Equity Out Transfer’ monetary transaction is automatically posted by the system to transfer Equity from existing (old) account to new account created as part of trade.

Equity Out transaction parameters

Transaction |

Parameters |

EQUITY OUT TRANSFER |

TXN DATE |

ACCOUNT NBR |

|

AMOUNT |

|

COMMENT |

|

TRADE TYPE |

On successfully posting the transaction, the ‘Equity Out’ field is updated in Account Details > Trade Details screen and a comment is posted on the existing (old) account in the format ACCOUNT EQUITY OUT TRANSFERRED ON <DATE> TO ACCOUNT NUMBER <ACCOUNT NUMBER> WITH VALUE <VALUE>, < TRADE TYPE > AND <COMMENT>.

A.1.32.4 Equity In Transfer Transaction

‘Equity In Transfer’ monetary transaction is automatically posted by the system to update Equity to new account created as part of trade.

Equity In transaction parameters

Transaction |

Parameters |

EQUITY IN TRANSFER |

TXN DATE |

ACCOUNT NBR |

|

AMOUNT |

|

COMMENT |

|

TRADE TYPE |

On successfully posting the transaction, the ‘Equity In’ field is updated in Account Details > Trade Details screen and a comment is posted on the existing (old) account in the format ACCOUNT EQUITY IN RECEIVED ON <DATE> FROM ACCOUNT NUMBER <ACCOUNT NUMBER> WITH VALUE <VALUE>, <TRADE TYPE> AND <COMMENT>.

A.1.32.5 Trade Fix Transaction

You can rectify the equity mismatch for a failed Trade transaction and process the Equity transfer by posting TRADE FIX monetary transaction in Customer Service > Maintenance > Transaction Batch Information section.

To post Trade Fix transaction

Transaction |

Parameters |

TRADE FIX |

TXN DATE |

PROCESS MASTER ACCOUNT |

|

PROCESS LINKED ACCOUNT |

|

VALIDATE COMMON CUSTOMER |

|

TRADE FIX REASON |

|

COMMENT |

This transaction is processed in the same workflow as similar to Trade Transaction. Refer to ‘Trade Transaction’ for details. In addition, you need to select the TRADE FIX REASON from the drop-down list while posting the transaction.

On successfully posting the transaction, a comment is posted on existing (old) account in the format ACCOUNT TRADED ON <DATE> WITH TOTAL TRADE EQUITY <VALUE> WITH <TRADE TYPE>, <TRADE FIX REASON> AND <COMMENT>.

A.1.32.6 Equity in Maintenance Transaction

You can override the ‘Equity In’ adjustments that are received in new account after Trade transaction by posting ‘EQUITY IN MAINTENANCE’ monetary transaction in Customer Service > Maintenance > Transaction Batch Information section.

To post Equity in Maintenance transaction

Transaction |

Parameters |

EQUITY IN MAINTENANCE |

TXN DATE |

AMOUNT |

|

COMMENT |

On successfully posting the transaction, the value specified in ‘Amount’ field is updated to ‘Equity In’ field in Trade Details sub tab of Account Details screen and a comment is posted on existing (old) account in the format ACCOUNT EQUITY IN MAINTAINED ON <DATE> WITH VALUE <VALUE>, <REASON> AND <COMMENT>.

A.1.33 Billing Cycle Change

You can change the billing cycle/statement of a Lease at any point of time during servicing by posting RESCHEDULE BILL CYCLE monetary transaction in Customer Service > Maintenance > Transaction Batch Information section.

Note the following before posting the transaction:

- The ‘Billing Cycle Change’ transaction creates significant impact in the system since it impacts the schedule, dues and sensitive account data on account. Hence it is recommended to be posted with careful consideration and OFSLL is not responsible for any impact/mismatch resulting out of this change.

- The ‘Billing Cycle Change’ transaction can be posted for both Open-Ended and Close-Ended Loans (Vehicle, Home Loan, and Unsecured), Lease and Line of Credit.

- The ‘Billing Cycle Change’ transaction is applicable for all methods like IBL (Interest Bearing Loans) and Amortized Loans.

- The ‘Billing Cycle Change’ transaction is ‘not’ applicable for Pre-compute Loans and for ‘Rent Factor Method’ of lease accounts.

- In case of any error while posting the transaction, system rolls-back all the changes on the account. Refer to OFSLL Release notes available in OTN library (https://docs.oracle.com/cd/F22291_01/references.htm) for additional information on 'Billing Cycle Change' transaction validations.

To post Billing Cycle Change transaction

Transaction |

Parameters |

RESCHEDULE BILL CYCLE |

TXN DATE |

|

PROCESS MASTER ASSOCIATED ACCOUNTS Select either Yes or No from the drop-down list. Selecting ‘Yes’ posts the transaction to Master Account and Associated Accounts. |

|

NEW BILLING Select the billing frequency from drop-down list. |

|

PROCESS SAME PRODUCT TYPE AND FUNDING TYPE ACCOUNTS Select either Yes or No from the drop-down list. Selecting ‘Yes’ posts the transaction on accounts belonging to same product type and selecting ‘No’ posts the transaction to ALL accounts. However, this parameter has no relevance if the 'Process to Master Account' is not set to 'Y'. |

|

PRE BILL DAYS Specify the pre-bill days on account. System displays an error if the PRE BILL DAYS is retained as zero ‘0’ (default value). |

|

DUE DAY MIN Specify the minimum due day to mark-up the due days limit on account to the required standard business rules. System displays an error if the DUE DAY MIN is retained as zero ‘0’ (default value). |

|

DUE DAY MAX Specify the maximum due day to mark-up the due days limit on account to the required standard business rules. System displays an error if the DUE DAY MAX is retained as zero ‘0’ (default value). |

|

MAX DUE DAY CHANGE DAYS Specify the total number of times due date change is permitted) on account. System performs a compatibility check for selected billing cycle. System displays an error if the MAX DUE DAY CHANGE DAYS is retained as zero ‘0’ (default value). |

|

RESCHEDULE PAYMENT START DATE Select the rescheduled/next payment date from the adjoining calendar. Ensure the date selected is not less than 'Last Due Date' (Current Due Date). |

|

PAYMENT AMOUNT If payment amount is specified, then system computes billing change calculation considering system parameter. This is applicable for individual accounts. Retaining as ‘0’ (default) allows system to auto-compute new payment amount during billing change calculation. Required for Master accounts. This field has no relevance for line accounts. |

|

TERM Enter the number of payments. System displays an error if the term is retained as zero ‘0’ (default value). This field has no relevance for line accounts. |

|

RESIDUAL PERCENT REMAINING Specify a value of residual percentage to be accounted in billing. This should not be greater than Account Residual percentage. This is mandatory to be specified if Maturity date is changed for Lease account. |

|

LATE CHARGE GRACE DAYS Specify the number of grace days allowed during billing change calculation. Retaining as ‘0’ (default) does not make any changes on account. |

|

LEASE EARLY TEMINATION Specify the amount to be paid for early termination. Retaining as ‘0’ (default) does not make any changes on account. |

|

COMMENTS |

For detailed information on above fields validation, computation of other transactions, 'Billing Cycle Change' transaction validations, refer to OFSLL Release notes available in OTN library (https://docs.oracle.com/cd/F22291_01/references.htm).

While posting the transaction:

- System allows 'Next Due date' after Current Due Date.

- The ‘Next Billing Date’ is computed after Current Due Date i.e. Next Due Date - Pre Bill Days.

- System allow backdating of this transaction till last due date.

- The ‘Paid Term’ is auto-computed considering the back dated payments (if any).

On successfully posting the transaction, system updates the billing changes to current/master account as defined and internally posts Due Date Change, Change Payment Amount, and Change Term transactions for new billing cycle to be established.

Billing Cycle Change Reversal

Reversal of ‘Reschedule Bill Cycle’ is allowed with following restrictions:

- System changes ‘Account back dated date’ as date of posting of transaction and hence no monetary transaction is allowed to post on or before that date. This implies, system does not allow to reverse the ‘Reschedule billing transaction’ on same date.

- System does not allow to reverse the transaction, if any monetary transaction is posted (except payoff quote), after posting reschedule billing transaction. User is expected to reverse the monetary transaction manually, to reverse the reschedule billing transaction.

A.1.34 Capitalization Maintenance

Capitalization maintenance helps to define the capitalization parameters to capitalize the corresponding account balances to principal balance based on specific frequency. For example, you can capitalize the accumulated Interest or Late Fees to principal balance of the account.

During servicing, you can either enable and define new capitalization parameters for an account or modify / disable the pre-defined capitalization parameters at any point by posting CAPITALIZATION MAINTENANCE monetary transaction in Customer Service > Maintenance > Transaction Batch Information section.

However, note that capitalization is supported only for 'Active' Accounts.

To post Capitalization Maintenance transaction

Transaction |

Parameters |

CAPITALIZATION MAINTENANCE |

TXN DATE |

|

CAPITALIZE Select either YES or NO (default) from drop-down list. |

|

BALANCE Select the type of balance to be capitalized from the drop-down list. Selecting ALL (default) capitalizes all the balances maintained for the account. |

|

FREQUENCY Select the required capitalization frequency from the drop-down list. The list contains the following types of frequency: - Based on specific intervals such as Monthly, Quarterly, Annual and so on. - Based on contract Billing Frequency, Billing Date, or Due date. - Specifically on every Month End. Note: Selecting Balance Frequency option here has no relevance for capitalization. |

|

CAP GRACE DAYS Specify the grace days allowed in the frequency (minimum 0, maximum 31) before capitalizing the balances to account. This is also the deciding factor for executing the capitalization batch job which is based on Capitalization Frequency + Grace Days. However, note that Grace Days are not accounted for Month End type of capitalization frequency and is ignored even if specified. |

|

CAP TOLERANCE AMT Specify the capitalization tolerance amount which is the minimum amount to qualify for capitalization. Any amount less than this is not considered for capitalization of balances. This helps to avoid capitalization of nominal or decimal amounts. Note: There is no specific accounting maintained for non-capitalized decimals with reference to setup. |

|

CAPITALIZE AMT TILL DATE Select either YES or NO (default) from the drop-down list. - Yes - to capitalize the balance amount till date and continue capitalization based on defined parameters. - No - to capitalize the balance amount till date and stop capitalization. NOTE: This parameter is useful only when the capitalization preference is changed from Y to N during servicing, by posting 'Capitalization Maintenance' transaction and if the capitalization was enabled during origination. For other combinations, this parameter is ignored for processing. |

|

CAPITALIZATION START DATE (INCLUDING GRACE DAYS) Select the next capitalization date from the adjoining calendar which by default includes the CAP GRACE DAYS before triggering the balance capitalization. |

On successfully posting the transaction, system deducts the corresponding balance amount and adds to Advance / Principal or Lease receivable balance based on the defined frequency.

Accordingly, as part of capitalization process two transactions are posted on the account and the same can be viewed in Customer Service > Transaction History > Transactions tab. Also, two entries are posted in Customer Service > Balances tab indicating the balance deduction in Capitalized (-) column and principal addition in Capitalized (+) column respectively.

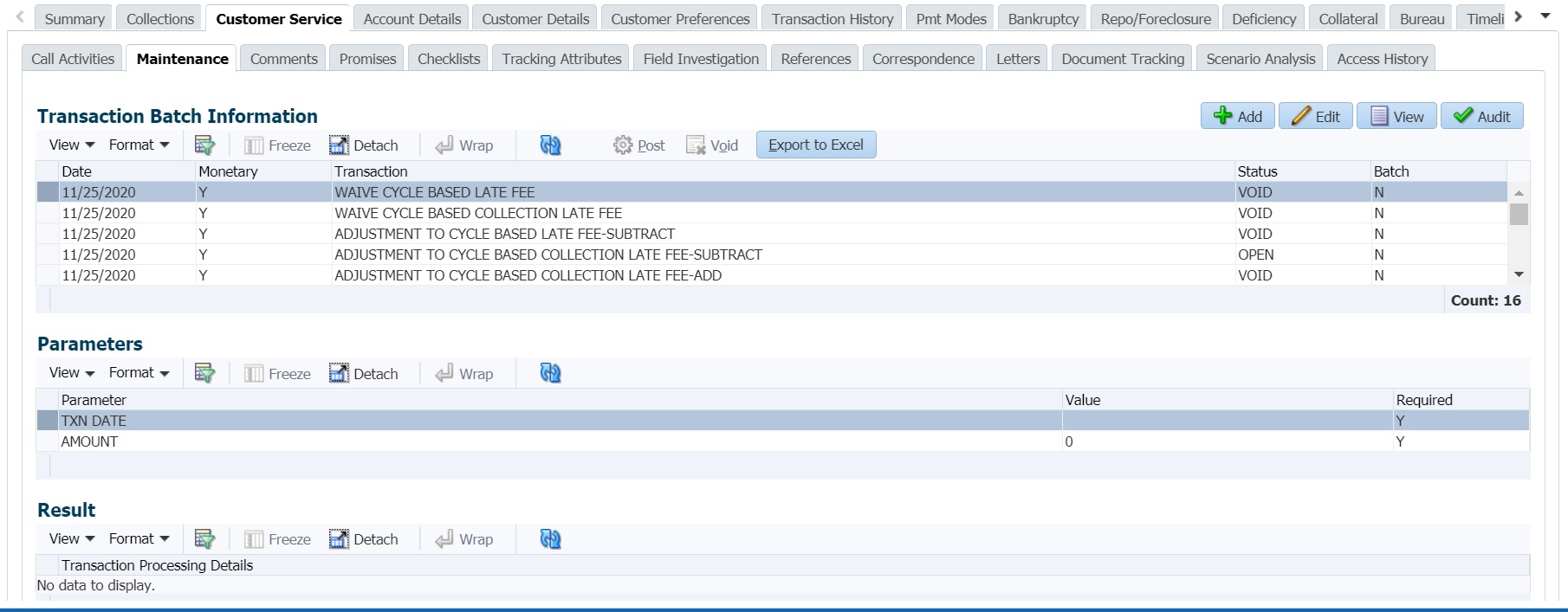

A.1.35 Cycle Based Late Fee Adjustment / Waiver

Late fee is the amount charged when payment is not made within the grace period or by the day after payment is due. The due date is determined by the contract.

Accordingly, the Cycle Based Late Fee Adjustment / Waiver is required to be done when such late fee corrections are to be posted on the account. This can be done during servicing by posting the following types of monetary transactions in Customer Service > Maintenance > Transaction Batch Information section.

To post Adjustment / Waive Maintenance transaction

Transaction |

Parameters |

ADJUSTMENT TO CYCLE BASED COLLECTION LATE FEE-ADD ADJUSTMENT TO CYCLE BASED COLLECTION LATE FEE-SUBTRACT WAIVE CYCLE BASED COLLECTION LATE FEE ADJUSTMENT TO CYCLE BASED LATE FEE-ADD ADJUSTMENT TO CYCLE BASED LATE FEE-SUBTRACT WAIVE CYCLE BASED LATE FEE |

TXN DATE Select the transaction date from adjoining calendar. |

AMOUNT Specify the amount to be adjusted / waived on the account. |

A.1.36 Fee Consolidation Maintenance

You can update and maintain Fee Consolidation to an Account during Servicing and Collection stage by posting ‘FEE CONSOLIDATION MAINTENANCE’ monetary transaction in Customer Service > Maintenance > Transaction Batch Information section.

Before posting the transaction, note that:

- The fields are updated only if the value of parameters is greater than zero.

- Transaction is allowed to be posted only those accounts which are linked to Master Account (Including Master Account).

- When Fee Consolidation at Master Account flags are checked, system validates if respective fee balance(s) are available at Master and Associated account or not. Balance validations is enforced only when both Master and Associated accounts have ‘Fee at Master Account flag = Y’.

- If the Account's billing Cycle is Monthly, Weekly, Bi-Weekly, Semi-Monthly, system validates if Late fee Grace Days > 28. Else displays an error.

- If late fee consolidation at Master is Y on Master account, then system validates if Associated Account has same respective fee grace days and fee cycle. Else displays an error.

While posting the fee consolidation on executing the scheduled batch jobs, the processing is done based on following matrix:

Flag |

Master Account (M1) |

Associated Account (A1) |

Action |

Late Charge at Master Account |

Y |

Y |

Loop through Master and Associated Accounts, Post Late Charge at Master Account and a Zero amount Late Charge transaction at Associated Account. |

Y |

N |